【現役SEが開発!】長期運用型EA Nexus EURGBP FX 自動売買 完全無料 無料EA ゴールドEA 自動収入 不労所得 投資 副業 MT4

Comments(0)

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

0JPYProfit Factor

:

0.00Rate of return risk

?

:

0Average Profit

:

0JPYAverage Loss

:

0JPYBalance

?

:

1,000,000JPYRate of return (all periods)?

:

0%Win Rate

:

0%

(0/0)

Maximum Position

?

:

0Maximum Drawdown

?

:

0%

(0JPY)

Maximum Profit

:

0JPYMaximum Loss

:

0JPYRecommended Margin

?

:

0JPYUnrealized P/L

:

0JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

※EA measurement is stopped

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2025

2024

2023

2022

2021

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

No Data

Calendar for Months

About EA's Strategy

Currency Pairs

[EUR/GBP]

Trading Style

[Scalping]

[Day Trading]

Maximum Number Position

15

Maximum Lot

0.09

Chart Time Frame

M1

Maximum Stop Loss

250

Take Profit

5

Straddle Trading

Yes

Application Type

Metatrader Auto Trading

Other File Usages

Yes

【Nexus EURGBP EAの特徴と、多くのFX自動売買ツールと異なる点】

①過去7年バックテストにて破綻無し(指標停止無しフルタイム稼働)

②相場状況に大きな不安を感じることもなく、月利20~30%を狙える放置安定型EA

③マイクロ口座、スタンダード口座の両方に対応

④280pips以上の耐久幅を持たせているので大きなボラティリティが発生しても余裕の維持率

⑤維持率によるエントリー制限や、稼働時間制限・経済指標自動停止機能、さらに二重の損切り機能でリスク軽減と堅実な利確を行う設計

⑥稼働時間設定機能が付与されており、ボラティリティの小さい東京時間のみに稼働させたりといった運用が可能

⑦維持率によるエントリー制限を設けており、維持率が極端に低下している場面ではポジション取得を制限

⑧ナンピンを10段以上担がれた場合は含み損±0にて決済を行い、危険な状況から早急に撤退する機能を実装(10~15段で設定可能)

⑨ナンピンフィルター搭載により、予期しない大きなボラテリティが発生した際に、破綻の要因となりうる短時間の多数のポジション取得も心配なし

➉経済指標自動停止機能を搭載しており、経済指標レベルを選択して自動で停止させることが可能

【取引を行う通貨ペア、EURGBP(ユロポン)の大きな魅力】

EURGBP専用EA『Nexus EURGBP』のユーロ()とポンド(£)の通貨ペアであるユロポン(ユーロポンド)は、直近過去5年間きれいなレンジ相場を作っているため大手証券会社も推奨している通貨ペアでとても人気です。

このようなレンジ相場を作る通貨ペアは、狭い値幅で行ったり来たり上下してくれるので、狭い値幅で利益確定を繰り返す今回出品しているスキャルピング系FX自動売買ツールに非常に向いています。

注目ポイントは、直近過去5年の実績というところです。もう一度、ユロポンの全体チャートを見てみましょう。ヨーロッパの経済圏同士の通貨ペアであり、地域的・経済的な密接が強いことから、普段はボラティリティが小さいことが特徴です。直近の5年間はAUDNZD(オージーキウイ)と同レベルの狭いレンジですが、昔のチャートは上に行ったり下に行ったり、結構激しく動いていました。(理由はチャートに記載)今後のことはわからないし、過去10~20年で見るとそれなりにレンジは広いということに注意しておきましょう。これはオージーキウイにも言えることです。

今回出品しているNexus EURGBPは、レンジの中で細かく動いて利確していくので、どんどん利益を積み上げてくれるシステムです。

【EURGBP専用EA『Nexus EURGBP』の便利な機能】

①全決済ボタン:その名の通りクリックすると保有ポジションが強制的に全決済されます。押した後は「EA稼働停止中」と表示され自動売買が停止します。再度ボタンを押すと自動売買が再開されます。

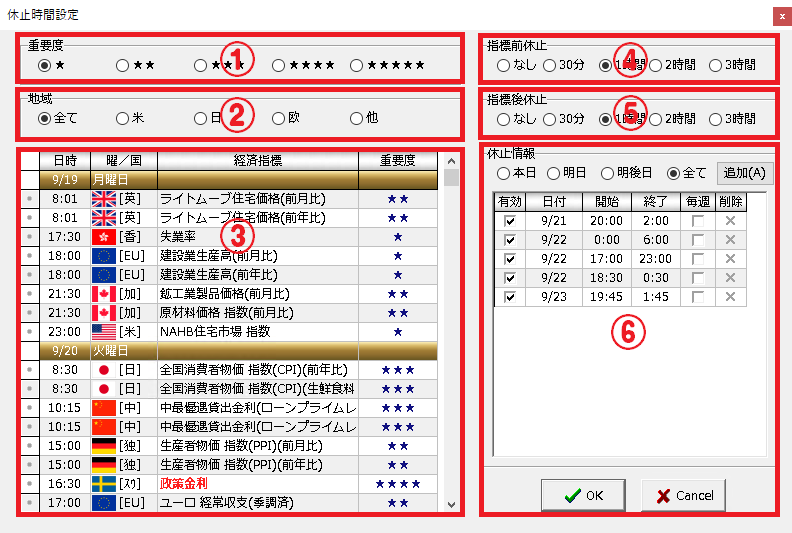

②経済指標自動停止機能:経済指標が予定されている時間前に自動でEAの停止を予約できる機能になります。最新版では自動で毎週予約が入るようになり、完全自動で稼働させることができます。

◆ 経済指標自動停止機能ができること ◆

【経済指標時の稼働停止】

FX自動売買ツールを経済指標前の指定した時間に稼働を停止したり、

経済指標後の指定した時間に稼働再開させることが可能です。"指標がある国"と"重要レベル"で指定することも可能です。

【指定した時間での稼働停止】

曜日単位での時稼働停止間の設定、または指定した日次の時間帯の設定が可能です。

【シンプルで使いやすい』

EAに機能が搭載されているため、パラメーター設定にて設定は行わず、チャート上のシンプルな設定画面にて設定するだけです。

①重要度

星1~星5を選択することで、経済指標の重要度で"③経済指標リスト"の項目を絞ることができます。

②地域

※米(アメリカ)日(日本)欧(欧州・ヨーロッパ全土)他(その他)から選択することで、経済指標リストの項目を絞ることができます。

③経済指標リスト

"①重要度"と"②地域"で絞られた項目がこちらに表示されます。"④指標前休止"と"⑤指標後休止の"時間を設定した後に指標名をダブルクリックすることで"⑥休止情報"に予約が追加されます。※開始時間が重複する時間に存在する指標への二重予約はできません。(意味がないため)

④指標前休止

なし~3時間から選択できます。※日本時間で設定されるため、時差などは考慮する必要はありません。

⑤指標後休止

なし~3時間から選択できます。※日本時間で設定されるため、時差などは考慮する必要はありません。

⑥休止情報

"③経済指標リスト"で追加された情報がこちらに入ります。有効のチェックボックスのチェックを外すと予約はキャンセルされますが、再度チェックを入れることで再予約可能になります。削除ボタンを押すとリストから削除されます。設定が完了したら下の『OK』ボタンを押すことで保存されます。※表示時間は日本時間です。

③俺ライン:俺ラインという、抵抗線・レジサポラインと言われるものを表示する機能になります。※希望者にのみ配布いたしますので御連絡ください。

【各種サポート】

初心者でも安心なメッセージ&マニュアルによるEA導入サポート

資金管理もしっかりお伝えします。

【注意事項】

投資は自己責任となります。

リスクがあることを理解した上自己責任の元、当EAをご利用ください。

資金管理はこちらで指導しますが、リスク回避の徹底をお願いします。

Sales from

:

-

Purchased: 0times

Price:¥30,000 (taxed)

●Payment

Forward Test

Back Test

Forward Test

Gaitame Finest Demo Account(Actual results may vary depending on circumstances, such as broker/customer's operating environment)

Open Date | Symbol | Buy/Sell | Open Price | S/L | T/P | Close Date | Close Price | Lots | Commission | Taxes | Swap | Net Profit | Profit/Loss |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Data is unavailable | |||||||||||||

Sales from : -

Purchased: 0times

Price:¥30,000 (taxed)

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working