Forward Warrior

- 全期間

- 2年

- 1年

- 6カ月

- 3カ月

- 1カ月

公式運用(収益額)

詳細統計(月別)

- 1月

- 2月

- 3月

- 4月

- 5月

- 6月

- 7月

- 8月

- 9月

- 10月

- 11月

- 12月

今月のカレンダーを表示

ストラテジーについて

Translating...

はじめに

皆様は安定的に稼げるEAとはどのようなものと考えていますか?バックテストの収益額が大きいもの、PFが良いもの、ドローダウンが低いもの、様々な見方があるかと思われます。私は10年以上の長い間、裁量トレードを経験し、多数のEAを開発してまいりました。そして生き残る事の出来るEAとは何かに気が付きました。それは『フォワードにロジックが一致したEA』です。

当たり前のことを言っているようにも思われますが、EAはあくまでも過去の値動きに対して最適化を行い結果を出しております。そして稼いでいるEAはたまたま未来の値動きに対してそのロジックが当てはまったに過ぎません。それが自動売買の本質でもあります。

であれば、そこにある程度の予測の上に当てはまりそうなロジックを開発したならばいかがでしょうか?逆に考えるとフォワードを意識していないEAはこの先大丈夫でしょうか?現在稼いでいるEAはたまたま相場に一致していませんか?

本EA『Forward Warrior』は上記の考えを基に安定的、効率的に資産を増やすことを目的として開発いたしました。

Forward Warriorについて

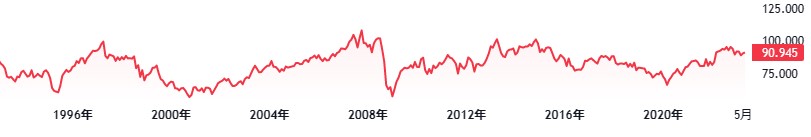

本EAはAUDJPYを採用しております。まずはAUDJPYの値動きをご覧ください。

長期目線で見ると現在は比較的高値圏で推移しています。月足で確認すると相場の過熱感を示すRSIは月足で50以上を27ヶ月維持した後に一度50を下回っています。同じような相場が2013年あたりでも確認でき、高値圏でレンジ相場の後に下落相場へと転換しています。

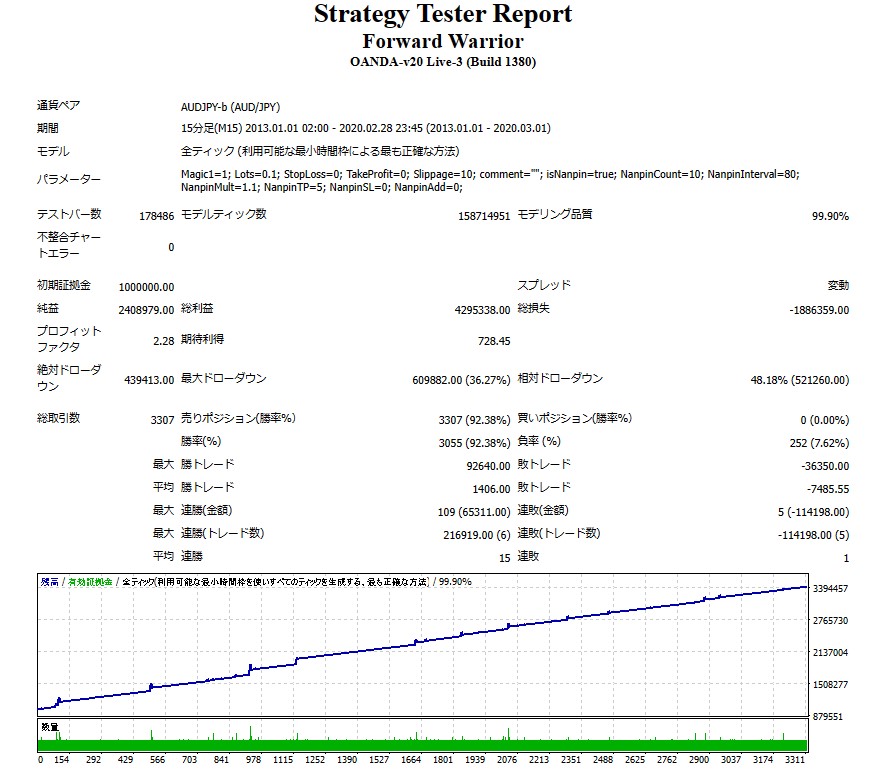

本EAは『レンジ相場~下落相場~反発を伴う上昇相場 or 短、中期的な上昇相場』をターゲットとして、売りのみでエントリーする様に開発いたしました。下に示すのは2013年1月から最安値をつけた2020年2月 を参考にバックテストを行った結果です。

バックテストのレポート上では、勝率「92.38%」となっておりますが、実質上は「100%」です。利益確定の時に複数ポジションを同時決済するために見られる現象です。最大ドローダウンも「36.72%」となっておりますが、複数ポジションを持った際でも含み益の状態で同時決済が行なわれますので残高が減ってしまうわけではありません。下に示す収支のようにマイナスの月は一度もありません。この収支はデフォルトのlot数での収支を表しております。AUDJPYは他通貨に比べて必要証拠金が少なく済むため、ロット数の調節がしやすく、初心者~上級者どの方でも扱いやすくなっています。また1000通貨からの取引も可能なためリスクを小さくすることも可能です。

本EAのロジックにはナンピンを取り入れています。ナンピンに対して悪いイメージを持たれている方もいるかと思われますが、上に示した年間収支のようにナンピンはレンジやトレンド方向に一致させたときに稼働させると絶大な威力を発揮いたします。一方で、ナンピンの弱点としてポジションとは反対方向への一方的かつ大幅な値動きがあげられます(一方的ではない反発を伴う値動きは逆に好機)。その点を踏まえて、本EAはロジックを高度に制御しており、優位性の高い取引を行うように調整しております。その証明にあえて2013年1月の急上昇相場からバックテストを開始し、さらに2014年10月からの一方的な急上昇(約1000pips)を経験させましたが、資産を減らすことなく乗り越え、継続的かつ安定的に資産を増やすことを確認できています。

パラメータ設定

パラメータ名 | 規定値 | 説明 |

Magic1 | 1 | 1以上の数値を設定します。同じ口座内で他のEAと同時稼動させる場合は、重複しないようにご注意ください。 |

Lots | 0.1 | 1ポジション目のロット数です(0.1=10000通貨)。 |

StopLoss | 0 | 1ポジション目の損切り(Pips)設定です。 |

TakeProfit | 0 | 1ポジション目の利食い(Pips)設定です。 |

Slippage | 10 | 注文価格と実際の約定価格の誤差の許容範囲となります。約定価格が設定したPips分以上乖離した価格の場合、約定は拒否されます。 |

isNanpin | true | ナンピンの有無の設定です。 |

NanpinCount | 9 | ナンピンによってポジションを追加する回数の上限を設定します。 |

NanpinInterval | 80 | ポジション追加をおこなう間隔をPips単位で設定します。 |

NanpinMult | 1.1 | 前回のエントリーの何倍のロット数でエントリーするのか、倍率を設定します。 |

NanpinMultTP | 5 | 初回エントリーポジションと、ナンピンによって追加されたポジションの利益の合計が設定した値(Pips)以上になった際に利食いが行われます。 |

NanpinMultSL | 0 | 初回エントリーポジションと、ナンピンによって追加されたポジションの損失の合計が設定した値(Pips)以上になった際に損切りが行われます。 |

NanpinAdd | 0 | 前回のエントリーに何ロット追加でエントリーするかを設定します。 |

2023年10月現在、豪ドルに関しては政策金利に区切りがつき、上昇トレンドはいったん落ち着きを見せ、レンジ相場となっています。今後レンジを超えて上昇トレンドが続いたとしても、円安の材料がほぼ出尽くしている状態かつ高値圏での状態では上昇トレンドに対する反発は必須と考えています(反発を伴う上昇は好機)。また上昇トレンドが続かない場合であればレンジ~下落相場となり、本EAの独壇場となります。現在の相場は本EAを稼働するにあたって非常にリスクが小さく済むと思われます。是非ご購入をご検討ください。

追記

2024年8月現在、日銀の利上げが遂行され完全にトレンドが切り替わました。初期に含み損の時期が大きくありましたが、むしろコンセプト通りに10円以上の値上がりに対しても25倍のレバレッジで耐えており、本EAの堅牢性が証明できたと思います。トレンドは切り替わったため2023~2024年の上昇を耐えた本EAは、今後数年間は安泰と考えます。

価格:¥19,800 (税込)

●お支払い方法

REAL TRADE

販売開始日 : 2023年5月24日 15時12分

価格:¥19,800 (税込)

●お支払い方法

裁量トレードと同じように、インジケーターを組み合わせて取引タイミングや決済タイミングを決めるもの、一定の価格(pips)間隔で買いや売りを繰り返すもの、相場のアノマリーや時間的特徴を利用した取引手法など、その種類は裁量トレードの手法と同じく豊富です。

簡単に分類すると、

・スキャルピング(数分~数時間以内で取引が完了するタイプ)、

・デイトレード(数時間~1日程度で取引が完了するタイプ)、

・スイング(1日以上~1週間程度の比較的長い期間をかけて取引を行うタイプ)

・ナンピン・マーチン(等間隔または不等間隔で複数のポジションを持ち、利益が出たら一括で決済をするタイプ。ロット数を段階的に上げていくものをマーチンゲールといいます。)

・アノマリーEA(仲値トレード、早朝スキャルピング)

などがあります。

ただし、自動売買は予めリスクを限定できる、予想できるということが大きな強みでもあります。

【リスク】

FX取引をする以上は取引リスクは自動売買にももちろん存在します。

・ロットサイズのリスク

勝率が高いからといってロットを無理に大きくすると、EAによってはまれに負けた時の損失Pipsが大きい場合があります。必ずSLのPipsや保有ポジション数を確認してから、適切なロットで運用しましょう。

・急激な相場変動リスク

指標発表や、突発的なニュースによって急激に相場が動くケースがあります。システムトレードはそのような予測できない相場の動きを想定していないため、事前に決済しておく、取引しないなどの判断が出来ません。対策としては指標発表やVIX(恐怖指数)でEAの停止を行うツールなどを使うことも可能です。

【メリット】

・24時間取引してくれる

システムトレードはあなたの代わりに取引できるチャンスがあれば、淡々とトレードを行ってくれます。トレードに時間を割けない方にとってはとても便利な武器になってくれるでしょう。

・感情にコントロールされることなく淡々とトレードしてくれる

裁量トレードで負けが続き、ロットを大きくしてみたり、逆に少ない利益ですぐに利確してしまうといった、人間にありがちなルールの自己都合化がありません。

・初心者でも始められる

FX取引を行うにはまず勉強から…といった必要がなく、誰が使っても同じ結果になるのがシステムトレードです。

【デメリット】

・取引頻度を自由に増やせない

システムトレードは予めプログラムされた条件通りに取引をするため、EAのタイプによっては月に何度かしか取引をしない場合もあります。

・相場に合う、合わないがある

EAの取引タイプによって、順張りに向いている時期、逆張りに向いている時期などがあるため、すべての期間において成績が一定になることは少ないです。去年は良かったが、今年はあまり成績が振るわないということもあるため、運用する時期なのかどうかをある程度裁量で判断する必要があります。

・MT4(MetaTrader4。MT4が使えるFX会社で口座開設をする必要があります)

・EA(自動売買用プログラム)

・EAを運用するのに必要な運用資金

・24時間稼働可能なPCまたはVPS(クラウドサーバー上に仮想PCを置き、そこでMT4を立ち上げておく)

また、口座にはデモ口座とリアル口座があり、デモ口座を申請すると仮想の資金でトレードを体験することができます。リアル口座を開設したあと、FX会社から割り振られた接続サーバーを選択し、パスワードを入力して口座にログインします。

FX会社に指定された方法で口座資金を入金すると、MT4口座に資金が反映されて取引ができるようになります。

まず、購入したEAファイルをGogoJungleのマイページからDLします。zip(圧縮)ファイルがDLされるので、右クリックで解凍して中の「◯◯◯(EA名称)_A19GAw09(任意の8英数字).ex4」というファイルを取り出します。

次に、MT4を立ち上げ、「ファイル」→「データフォルダを開く」→「MQL4」→「Experts」フォルダーの中に、ex4ファイルを入れます。MT4を一度閉じ、再起動したら、上部メニューの「ツール」→「オプション」の「エキスパートアドバイザー」の「自動売買を許可する」、「DLLの使用を許可する」にチェックを入れてOKを押して閉じます。

EAの正しい運用に必要な通貨ペアと時間足がEA販売ページに書いてあるので、それを参照して正しい通貨ペアの時間足のチャートを開きます(例:USDJPY5M ドル円5分足)。

メニューのナビゲーター内、「エキスパートアドバイザ」に先ほど入れたEAファイル名があるので、クリックして選択し、そのままドラッグ&ドロップでチャート内にEAを載せます。EA名ダブルクリックでも、選択されているチャートに載せることができます。

チャート上の左上に、「Authentification Success」と出れば認証成功です。 EAの運用には、24時間PCを立ち上げて置く必要がありますので、自動スリープ機能を解除するか、VPS上にMT4を置いてEAを運用ください。

認証されている口座以外で利用したい場合は、登録口座をリセットする必要があります。

口座のリセット方法は、Web認証が登録されているMT4を閉じている状態で、

GogoJungleのマイページ>利用する>デジタルコンテンツ>該当のEA>登録番号の「リセット」ボタンを押すと、登録口座が解除されます。

口座がリセットされている状態で、他のMT4口座でEAを利用すると、新たに口座が登録されます。

また、口座のリセットは無制限に行っていただけます。

→ EAが動かない時にチェックする項目

1ロット=10万通貨

0.1ロット=1万通貨

0.01ロット=1000通貨

となります。

ドル円であれば1ロット=10万ドルを保有することになります。

ロット保有にかかる証拠金はFX会社の定めるレバレッジによって決まります。

レバレッジ25倍であれば、1万通貨のドル円を保有するのに必要な証拠金は 10000*109(※1ドル109円レート時)÷25 = 43,600円 となります。

・リスクリターン率:期間中損益の合計÷最大ドローダウン

・最大ドローダウン:運用期間中の最大含み損

・最大ポジション数:そのEAが理論上同時に持ちうる最大のポジション数です

・TP(Take Profit):EAの設定上の利確Pips(または指定された金額など)

・SL(Stop Loss):EAの設定上の最大損失pips(または指定された金額など)

・トレーリングストップ:決済を指定のPipsで行うのではなく、一定の利益が出たら決済SLを一定の間隔で引き上げて(利益の方向へ)行く、利益を最大化する決済方法です。

・リスクリワード率(ペイオフレシオ):平均利益÷平均損失

・両建て:買いと売りを同時に保有すること(一部のFX会社では両建て不可のタイプもあります)

人気商品

特定商取引法に基づく表示

株式会社ゴゴジャン

早川忍

〒113-0033

東京都文京区本郷3-6-6 本郷OGIビル6F

お問い合わせページよりお願い致します。

03-5844-6090

月曜日~金曜日

10:00~19:00

セミナーのリアルタイム動画配信サービス・動画配信サービス、対面式セミナー、電子書籍、ソフトウェア、シグナル配信、セミナーのビデオ

※セミナーのリアルタイム動画配信サービスとは、セミナー実施時に即時弊社サーバーより配信するサービスです。

※セミナーの動画配信サービスとは、保存されたセミナー動画を弊社サーバーより配信するサービスです。

※セミナーのビデオとは、保存されたセミナー動画をお客様のPCにダウンロードするサービスです。

各商品の販売価格は、商品ページにて税込価格で表示しております。

オンライン上でのダウンロード、または配信

https://www.gogojungle.co.jp/

原則として弊社によるお客様のご入金完了後即ご提供いたします。

銀行振り込みご利用の場合は、商品代金(税込表示)に加えて振り込み手数料がかかります。

ホームページ上の専用申込フォームよりご注文ください。

銀行振込 / クレジットカード決済/ Web口座振替/ コンビニ決済

ファミリーマートでのお支払い方法

デイリーヤマザキ・ヤマザキデイリーストアーでのお支払い方法

お申込み日から2日以上経つ場合、お申込をキャンセルさせていただきます。予めご了承ください。

1.セミナーのリアルタイム動画配信サービス、動画配信サービスは配信実施24時間前以降のキャンセルはお受けいたしておりません。ご返金対応ができませんので十分ご注意ください。

2.対面式セミナーは、開催の3営業日前以降のキャンセルおよびご返金はお受けいたしておりません。

3.電子書籍、ソフトウェア、ビデオは、著作権保護の観点からお客様のダウンロード実施、または購読開始以降はキャンセルできません。ご返金対応ができません。予めご了承ください。

お客様のご都合によるご返金は、銀行振込・コンビニ決済・Web口座振替の場合振込手数料がすべてお客様負担となります。

カード決済ご利用の場合手数料は生じません。あらかじめご了承ください。

当ページに記載する「発送方法、ご提供方法」「発送時期、 ご提供時期」「代金以外の必要料金」「注文方法」「お支払い方法・期限」

「商品注文後のキャンセル」「返金にかかる費用」の各項目はGogoJungleで販売する全ての商品に適用されますが、商品毎にご案内がある場合は、

商品毎に記載いたします。

GogoJungleが販売者である場合は、商品ページにGogoJungleの「特定商取引に関する法律」に基づく表記を行ないます。

出品者が販売者であり、且つ出品者が「事業者」である場合は、出品者の「特定商取引に関する法律」に基づく表記を行ないます。

出品者が「事業者」に該当するかは出品者の判断によります。ただし、 経済産業省 特定商取引法の通達の改正について

「インターネット・オークションにおける「販売業者」に係るガイドライン」

https://www.caa.go.jp/policies/policy/consumer_transaction/amendment/2016/pdf/amendment_171206_0001.pdf

を鑑み「事業者」であることが明らかな出品者については、「事業者」として扱い開示請求があった場合は迅速に対応します。