超インジロボ☆グレートコンバッタM

Comments(41)

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

182,264JPYProfit Factor

:

2.31Rate of return risk

?

:

3.65Average Profit

:

2,116JPYAverage Loss

:

-1,202JPYBalance

?

:

1,182,264JPYRate of return (all periods)?

:

44.72%Win Rate

:

56.73%

(156/275)

Maximum Position

?

:

4Maximum Drawdown

?

:

7.82%

(49,885JPY)

Maximum Profit

:

15,045JPYMaximum Loss

:

-16,725JPYRecommended Margin

?

:

407,545JPYUnrealized P/L

:

0JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2025

2024

2023

2022

2021

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

No Data

Calendar for Months

About EA's Strategy

Currency Pairs

[EUR/JPY]

[USD/CHF]

[USD/JPY]

[USD/CAD]

[EUR/GBP]

[EUR/AUD]

[EUR/CHF]

[GBP/CHF]

[CAD/JPY]

[GBP/JPY]

[AUD/CAD]

[AUD/CHF]

[AUD/JPY]

[CHF/JPY]

[EUR/NZD]

[EUR/CAD]

[CAD/CHF]

[NZD/JPY]

[GBP/AUD]

[GBP/NZD]

[GBP/CAD]

Trading Style

[Day Trading]

[Swing Trading]

[Position Trading]

Maximum Number Position

4

Maximum Lot

0.5

Chart Time Frame

M15

Maximum Stop Loss

50

Take Profit

0

Straddle Trading

Yes

Application Type

Metatrader Auto Trading

Other File Usages

No

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

フォワード好調、22通貨運用対応「いいこと取り」EA

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

この度は、本EAをご覧頂きありがとうございます。

このEAは超インジロボ☆コンバッタMの別バージョン版で

グレードアップを目的として開発しました。

■■■■■■■■■■■■■■■■■■■■■■■■■■■■■■

コンバッタMのエントリー条件の優位性に

上がればトレイリングストップ、下がればナンピンと

エグジット条件を利益率重視に設定、ナンピンも1回に限定し

低ドローダウン志向の投資戦略ツールとして優位性を確立致しました。

☆彡5種類のマイナーインジケーターを採用☆彡

RVI ==相場のボラティリティを判断

アリゲーター ==トレンドをキャッチ

フラクタル ==ボックスをキャッチ

デマーカー ==トレンド転換をキャッチ

パラボリック ==トレンド転換をキャッチ

上記5つのインジをボリンジャーバンドと融合させ優位性を高めています

<<安定したフォワード実績>>

☆バックテストの検証☆

バックテストの成績をフォワード実績と

比較検証してみました。

◆検証期間

フォワード実績

計測期間:2019年8月13日~2021年3月28日

バックテスト

計測期間 :2009年8月1日~2019年8月1日

◆通貨ペア

EURJPY

◆プロフィットファクター

フォワードテスト 4.74

バックテスト 1.63

◆リスクリターン率

フォワードテスト 3.95

バックテスト 4.85

◆勝率

フォワードテスト 56.25%

バックテスト 54.49%

◆最大ドローダウン

フォワードテスト 7.04%

バックテスト 5.64%

◆取引回数

フォワードテスト 112回

10年換算

フォワードテスト 689回

バックテスト 613回

上記、バックテストでの成績に劣らないフォワード結果を

継続中です。

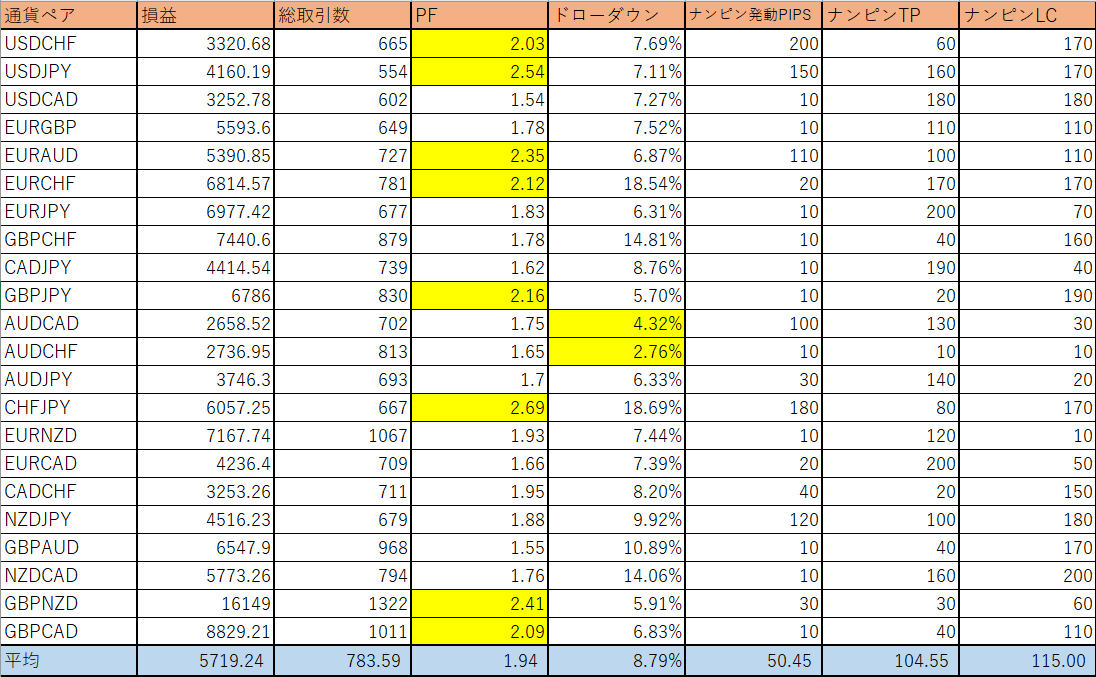

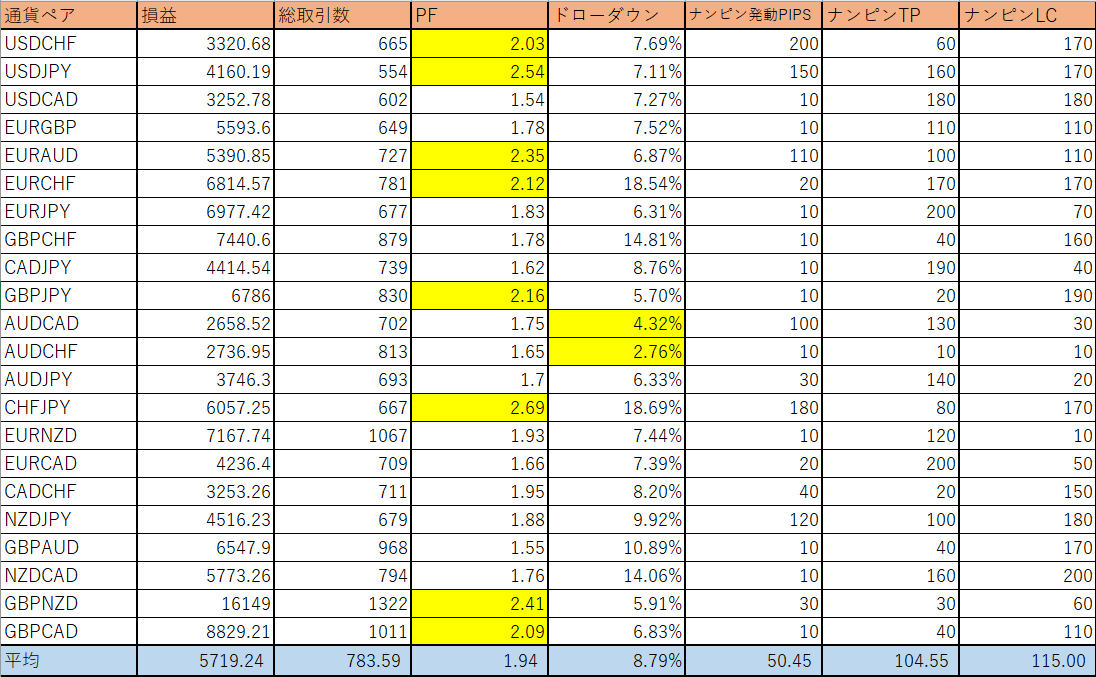

◆22通貨ペア対応(10年バックテストPF1.50以上)

バックテストPF1.5以上の成績を22通貨ペアで達成!

クロスレート3通貨を敢えて同じ設定にて運用する事で

リスクコントロールにも対応致しました。

平均PF1.94 平均ドローダウン8.8%(スプレッド20、FXDDで実施)

バックテスト通貨別成績表(設定は通貨毎別設定)

EURAUD10年

EURAUD10年

EURJPY10年

EURJPY10年

GBPNZD10年

GBPNZD10年

◆クロスレートの優位性について

クロスレートの重なり合いについて

通貨ペアの価格設定は、ドルストレートとクロスレートがあり、

通貨ペアの分子、分母にドルが無い通貨に関しては

対ドルのペアから逆算した相対値となります。

詳しくは下記サイトなど参照

https://www.oanda.jp/lab-education/blog_column/dollar_straight/

https://fx-quicknavi.com/fxcurrency/dollar-straight-cross-yen/

これをうまく活用すると、ロットとPip数など相対値をすべて

合わせて、下記のようにクロスレートを反対売買でエントリーをすると

スワップ、スプレッドなどを無視した場合、

永遠に損益を0に引き分けが続く事になります。

例

GBP/JPY 売りEUR/GBP売りEUR/JPY買い

GBP/JPYとEUR/GBPはGBPが分子と分母で反対なので同じポジション(売り)

EUR/GBPとEUR/JPYについてはEURが同じ分子なので反対ポジション(売りと買い)

必然的にGBP/JPYとEUR/JPYは反対売買となり、3すくみとなり

これを同じボリュームでエントリーすると片方の通貨ペアで負けても、

他の2通貨の総和がプラスとなるのでずっと引き分けとなる理屈となります。

※基本的に引き分けにするメリットはありませんが、

これをEAに当てはめると、成績が良いクロスレート通貨ペアを

設定が同じ条件、同じEAで運用すると、

長期的に見て優位性を保つ事が出来るのでは、と言う一つの見方が出来ます。

◆クロスレート別共通設定例(バックテスト)

※バックテストからの設定例

GBPJPY/EURGBP/EURJPY

//GBPJPYの推奨条件に合わせた場合//

ナンピン発動PIPS = 10

ナンピンTP = 20

ナンピンLC = 190

GBPJPY PF2.14

◆クロスレートの優位性について

クロスレートの重なり合いについて

通貨ペアの価格設定は、ドルストレートとクロスレートがあり、

通貨ペアの分子、分母にドルが無い通貨に関しては

対ドルのペアから逆算した相対値となります。

詳しくは下記サイトなど参照

https://www.oanda.jp/lab-education/blog_column/dollar_straight/

https://fx-quicknavi.com/fxcurrency/dollar-straight-cross-yen/

これをうまく活用すると、ロットとPip数など相対値をすべて

合わせて、下記のようにクロスレートを反対売買でエントリーをすると

スワップ、スプレッドなどを無視した場合、

永遠に損益を0に引き分けが続く事になります。

例

GBP/JPY 売りEUR/GBP売りEUR/JPY買い

GBP/JPYとEUR/GBPはGBPが分子と分母で反対なので同じポジション(売り)

EUR/GBPとEUR/JPYについてはEURが同じ分子なので反対ポジション(売りと買い)

必然的にGBP/JPYとEUR/JPYは反対売買となり、3すくみとなり

これを同じボリュームでエントリーすると片方の通貨ペアで負けても、

他の2通貨の総和がプラスとなるのでずっと引き分けとなる理屈となります。

※基本的に引き分けにするメリットはありませんが、

これをEAに当てはめると、成績が良いクロスレート通貨ペアを

設定が同じ条件、同じEAで運用すると、

長期的に見て優位性を保つ事が出来るのでは、と言う一つの見方が出来ます。

◆クロスレート別共通設定例(バックテスト)

※バックテストからの設定例

GBPJPY/EURGBP/EURJPY

//GBPJPYの推奨条件に合わせた場合//

ナンピン発動PIPS = 10

ナンピンTP = 20

ナンピンLC = 190

GBPJPY PF2.14

EURGBP PF1.57

EURGBP PF1.57

EURJPY PF1.59

EURJPY PF1.59

当EAはこのようなクロスレートによる運用に対応でき、

リスク管理としての幅が広がるかと思います。

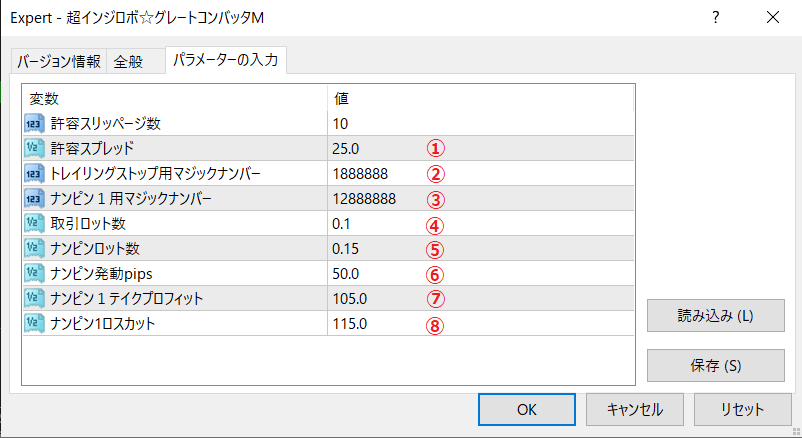

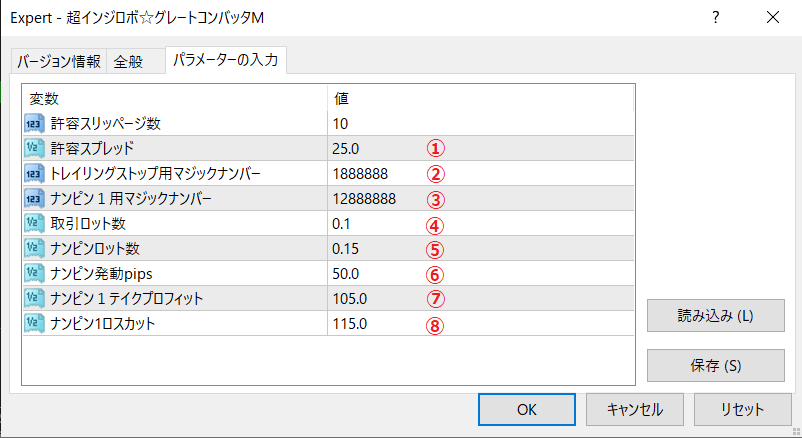

◆パラメーターの説明

当EAはこのようなクロスレートによる運用に対応でき、

リスク管理としての幅が広がるかと思います。

◆パラメーターの説明

①許容スプレッド

許容したスプレッドより、スプレッドとスリッページを加算した値が

下回らないとエントリー出来ないようになっています。

②トレイリングストップ用マジックナンバー

ナンピン用とロジックが違うので重ならない様に桁を変えて設定してください。

③ナンピン1用マジックナンバー

トレイリングストップ用マジックナンバーと重ならない様に桁を変えて設定してください。

④取引ロット数

トレイリングストップ用のエントリーの際のロット設定です。

⑤ナンピンロット数

ナンピン1発動時のロット設定です。

⑥ナンピン発動pips

最初のエントリーからナンピンが発動するまでの幅を設定します。

設定されたpips数までマイナス方向へ動いた時にナンピンが発動します。

⑦ナンピン1テイクプロフィット

ナンピンポジションの利確値を設定します。ナンピン決済時同時に

最初の同じポジション側エントリーも決済されます。

⑧ナンピン1ロスカット

ナンピンポジションの損切の値を設定します。ナンピン損切と同時に

最初の同じポジション側エントリーも決済されます。

フォワード好調ですが、取引会社やPC環境等で成績の差異があったり

急激な相場の転換等、不測の事態により状況は変わる事もあります。

その辺りもご考慮頂きまして、ご検討いただいた上でご利用頂けましたら幸いです。

①許容スプレッド

許容したスプレッドより、スプレッドとスリッページを加算した値が

下回らないとエントリー出来ないようになっています。

②トレイリングストップ用マジックナンバー

ナンピン用とロジックが違うので重ならない様に桁を変えて設定してください。

③ナンピン1用マジックナンバー

トレイリングストップ用マジックナンバーと重ならない様に桁を変えて設定してください。

④取引ロット数

トレイリングストップ用のエントリーの際のロット設定です。

⑤ナンピンロット数

ナンピン1発動時のロット設定です。

⑥ナンピン発動pips

最初のエントリーからナンピンが発動するまでの幅を設定します。

設定されたpips数までマイナス方向へ動いた時にナンピンが発動します。

⑦ナンピン1テイクプロフィット

ナンピンポジションの利確値を設定します。ナンピン決済時同時に

最初の同じポジション側エントリーも決済されます。

⑧ナンピン1ロスカット

ナンピンポジションの損切の値を設定します。ナンピン損切と同時に

最初の同じポジション側エントリーも決済されます。

フォワード好調ですが、取引会社やPC環境等で成績の差異があったり

急激な相場の転換等、不測の事態により状況は変わる事もあります。

その辺りもご考慮頂きまして、ご検討いただいた上でご利用頂けましたら幸いです。

EURAUD10年

EURAUD10年

EURJPY10年

EURJPY10年

GBPNZD10年

GBPNZD10年

◆クロスレートの優位性について

クロスレートの重なり合いについて

通貨ペアの価格設定は、ドルストレートとクロスレートがあり、

通貨ペアの分子、分母にドルが無い通貨に関しては

対ドルのペアから逆算した相対値となります。

詳しくは下記サイトなど参照

https://www.oanda.jp/lab-education/blog_column/dollar_straight/

https://fx-quicknavi.com/fxcurrency/dollar-straight-cross-yen/

これをうまく活用すると、ロットとPip数など相対値をすべて

合わせて、下記のようにクロスレートを反対売買でエントリーをすると

スワップ、スプレッドなどを無視した場合、

永遠に損益を0に引き分けが続く事になります。

例

GBP/JPY 売りEUR/GBP売りEUR/JPY買い

GBP/JPYとEUR/GBPはGBPが分子と分母で反対なので同じポジション(売り)

EUR/GBPとEUR/JPYについてはEURが同じ分子なので反対ポジション(売りと買い)

必然的にGBP/JPYとEUR/JPYは反対売買となり、3すくみとなり

これを同じボリュームでエントリーすると片方の通貨ペアで負けても、

他の2通貨の総和がプラスとなるのでずっと引き分けとなる理屈となります。

※基本的に引き分けにするメリットはありませんが、

これをEAに当てはめると、成績が良いクロスレート通貨ペアを

設定が同じ条件、同じEAで運用すると、

長期的に見て優位性を保つ事が出来るのでは、と言う一つの見方が出来ます。

◆クロスレート別共通設定例(バックテスト)

※バックテストからの設定例

GBPJPY/EURGBP/EURJPY

//GBPJPYの推奨条件に合わせた場合//

ナンピン発動PIPS = 10

ナンピンTP = 20

ナンピンLC = 190

GBPJPY PF2.14

◆クロスレートの優位性について

クロスレートの重なり合いについて

通貨ペアの価格設定は、ドルストレートとクロスレートがあり、

通貨ペアの分子、分母にドルが無い通貨に関しては

対ドルのペアから逆算した相対値となります。

詳しくは下記サイトなど参照

https://www.oanda.jp/lab-education/blog_column/dollar_straight/

https://fx-quicknavi.com/fxcurrency/dollar-straight-cross-yen/

これをうまく活用すると、ロットとPip数など相対値をすべて

合わせて、下記のようにクロスレートを反対売買でエントリーをすると

スワップ、スプレッドなどを無視した場合、

永遠に損益を0に引き分けが続く事になります。

例

GBP/JPY 売りEUR/GBP売りEUR/JPY買い

GBP/JPYとEUR/GBPはGBPが分子と分母で反対なので同じポジション(売り)

EUR/GBPとEUR/JPYについてはEURが同じ分子なので反対ポジション(売りと買い)

必然的にGBP/JPYとEUR/JPYは反対売買となり、3すくみとなり

これを同じボリュームでエントリーすると片方の通貨ペアで負けても、

他の2通貨の総和がプラスとなるのでずっと引き分けとなる理屈となります。

※基本的に引き分けにするメリットはありませんが、

これをEAに当てはめると、成績が良いクロスレート通貨ペアを

設定が同じ条件、同じEAで運用すると、

長期的に見て優位性を保つ事が出来るのでは、と言う一つの見方が出来ます。

◆クロスレート別共通設定例(バックテスト)

※バックテストからの設定例

GBPJPY/EURGBP/EURJPY

//GBPJPYの推奨条件に合わせた場合//

ナンピン発動PIPS = 10

ナンピンTP = 20

ナンピンLC = 190

GBPJPY PF2.14

EURGBP PF1.57

EURGBP PF1.57

EURJPY PF1.59

EURJPY PF1.59

当EAはこのようなクロスレートによる運用に対応でき、

リスク管理としての幅が広がるかと思います。

◆パラメーターの説明

当EAはこのようなクロスレートによる運用に対応でき、

リスク管理としての幅が広がるかと思います。

◆パラメーターの説明

①許容スプレッド

許容したスプレッドより、スプレッドとスリッページを加算した値が

下回らないとエントリー出来ないようになっています。

②トレイリングストップ用マジックナンバー

ナンピン用とロジックが違うので重ならない様に桁を変えて設定してください。

③ナンピン1用マジックナンバー

トレイリングストップ用マジックナンバーと重ならない様に桁を変えて設定してください。

④取引ロット数

トレイリングストップ用のエントリーの際のロット設定です。

⑤ナンピンロット数

ナンピン1発動時のロット設定です。

⑥ナンピン発動pips

最初のエントリーからナンピンが発動するまでの幅を設定します。

設定されたpips数までマイナス方向へ動いた時にナンピンが発動します。

⑦ナンピン1テイクプロフィット

ナンピンポジションの利確値を設定します。ナンピン決済時同時に

最初の同じポジション側エントリーも決済されます。

⑧ナンピン1ロスカット

ナンピンポジションの損切の値を設定します。ナンピン損切と同時に

最初の同じポジション側エントリーも決済されます。

フォワード好調ですが、取引会社やPC環境等で成績の差異があったり

急激な相場の転換等、不測の事態により状況は変わる事もあります。

その辺りもご考慮頂きまして、ご検討いただいた上でご利用頂けましたら幸いです。

①許容スプレッド

許容したスプレッドより、スプレッドとスリッページを加算した値が

下回らないとエントリー出来ないようになっています。

②トレイリングストップ用マジックナンバー

ナンピン用とロジックが違うので重ならない様に桁を変えて設定してください。

③ナンピン1用マジックナンバー

トレイリングストップ用マジックナンバーと重ならない様に桁を変えて設定してください。

④取引ロット数

トレイリングストップ用のエントリーの際のロット設定です。

⑤ナンピンロット数

ナンピン1発動時のロット設定です。

⑥ナンピン発動pips

最初のエントリーからナンピンが発動するまでの幅を設定します。

設定されたpips数までマイナス方向へ動いた時にナンピンが発動します。

⑦ナンピン1テイクプロフィット

ナンピンポジションの利確値を設定します。ナンピン決済時同時に

最初の同じポジション側エントリーも決済されます。

⑧ナンピン1ロスカット

ナンピンポジションの損切の値を設定します。ナンピン損切と同時に

最初の同じポジション側エントリーも決済されます。

フォワード好調ですが、取引会社やPC環境等で成績の差異があったり

急激な相場の転換等、不測の事態により状況は変わる事もあります。

その辺りもご考慮頂きまして、ご検討いただいた上でご利用頂けましたら幸いです。

¥1,000 coupon applicable.

The coupon expires today.

The coupon expires today.

×

Sales from

:

09/23/2020 23:59

Purchased: 23times

Price:¥25,000 (taxed)

About 1-Click Order

●Payment

Forward Test

Back Test

Forward Test

FOREX EXCHANGE Demo Account(Actual results may vary depending on circumstances, such as broker/customer's operating environment)

Open Date | Symbol | Buy/Sell | Open Price | S/L | T/P | Close Date | Close Price | Lots | Commission | Taxes | Swap | Net Profit | Profit/Loss |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Data is unavailable | |||||||||||||

¥1,000 coupon applicable.

The coupon expires today.

The coupon expires today.

×

Sales from : 09/23/2020 23:59

Purchased: 23times

Price:¥25,000 (taxed)

About 1-Click Order

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working