Slinky

- 全期間

- 2年

- 1年

- 6カ月

- 3カ月

- 1カ月

収益

:

-47,671円プロフィットファクター

:

0.94リスクリターン率

?

:

-0.61平均利益

:

2,983円平均損失

:

-4,011円口座残高

?

:

952,329円収益率(全期間)?

:

-21.59%勝率

:

55.74%

(233/418)

最大保有ポジション数

?

:

1最大ドローダウン

?

:

32.17%

(78,079円)

最大利益

:

3,360円最大損失

:

-4,510円推奨証拠金

?

:

220,772円含み収益

:

0円初期額

?

:

1,000,000円通貨

:

円建て

運用可能会社

MT4採用会社でご利用いただけます

※EAの計測は停止しております。

公式運用(収益額)

商品のデータ

商品のコミュニティ

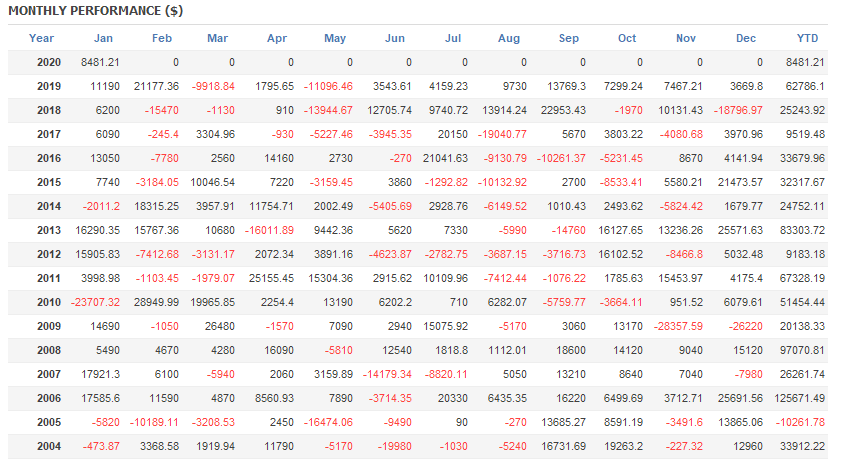

詳細統計(月別)

2026

2025

2024

2023

2022

- 1月

- 2月

- 3月

- 4月

- 5月

- 6月

- 7月

- 8月

- 9月

- 10月

- 11月

- 12月

今月のカレンダーを表示

ストラテジーについて

Translating...

通貨ペア

[USD/JPY]

取引スタイル

[スイングトレード]

最大ポジション数

1その他: 設定可能

最大ロット数

1その他: 証券会社による

使用時間足

M15

最大ストップロス

40その他: 設定可能

テイクプロフィット

30その他: 設定可能

両建て

なし

出品タイプ

メタトレーダー自動売買システム

その他ファイルの使用

なし

特記事項

手厚いサポートができませんので、基本的なEA運用ができる方のみお願いします。

ご覧いただきありがとうございます。

初出品になります。

本EAはEAつくーるにて作成したEAです。作者にプログラミングの知識は無く、機能追加の要望をいただいたとしても満足に対応する事はできない可能性が高いです。

現状USD/JPYのM15にて良い成績が出るであろう事がバックテスト上ではわかっております。

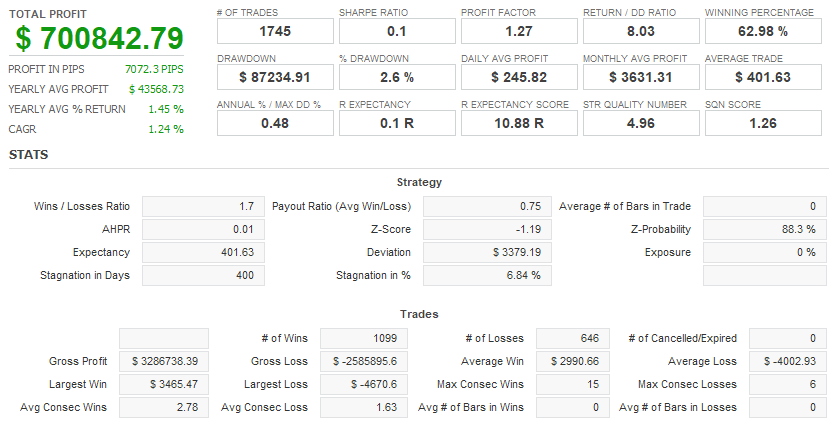

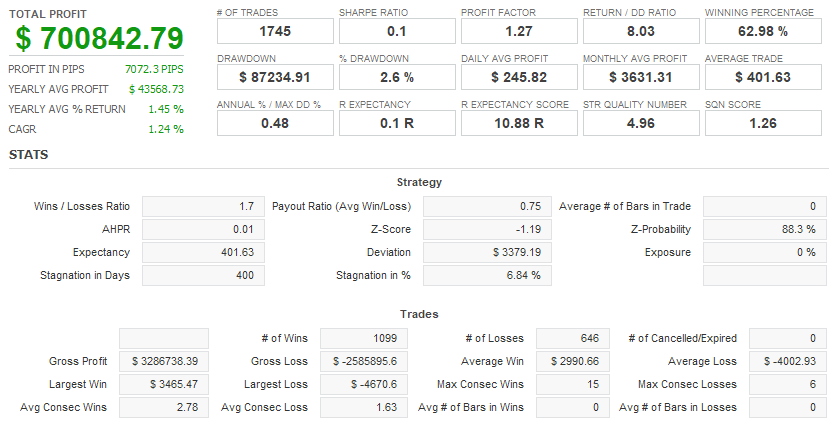

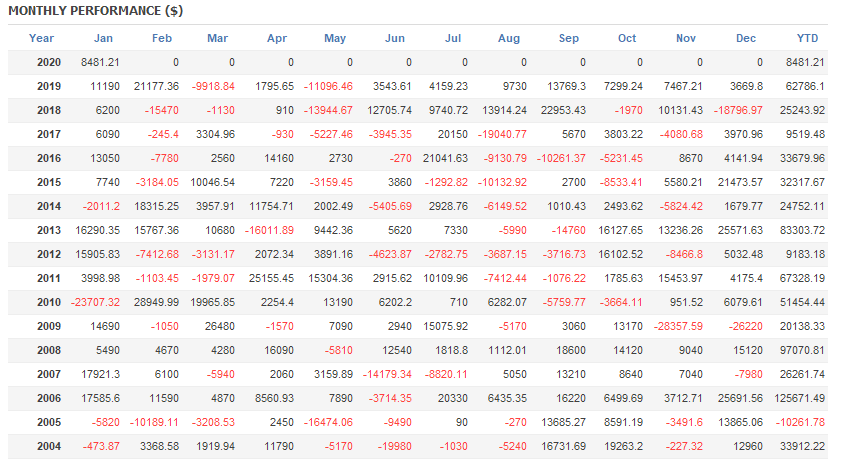

上記は2004年から2020年1月までのバックテスト結果チャートとなっております。

通貨制限・時間軸制限無しのパラメーターは全部開放の為、ほかにどのような通貨ペア・時間軸に通用するかはわかりませんがそれを見つける楽しみがあるEAだと思います。

EAの設置に関する部分や、どの証券会社で使用できるか?最適化の方法等を質問いただいても即時回答が難しい為、初心者が手を出しずらい相場より高めの価格で出品させていただきました。

既にEA運用にて利益が出ていて余裕のある、検証やセッティングが好きな方に色々いじって遊んでいただけたら幸いです。

ロジックはボリンジャーバンドを使用した逆張りで、極簡単なものとなっております。

内部決済ロジックは入れておらず、TP/SLを指定して決済するタイプとなっております。(Ver3.0にて内部決済ロジックを導入しました。ON/OFF可能です)

両建てはしない仕様となっております。初期では1ポジのスイングトレードEAのような感じです。

最適化は行っておらず、1回目でそこそこの右肩上がりになっていたのでエントリー時間制限(パラメーターにて3分割調整可能)を行い、今の状態にしております。

年間取引数がUSD/JPYのM15ですと平均で100回前後となっており、多頻度エントリーではありません。

ボリンジャーバンドで参照する時間軸は固定しておらず、セットしたチャート次第ですので選んだ通貨ペア・時間軸次第でエントリー回数も変わってきます。

ここからパラメーターの説明を書きます。

MAGIC1:マジックナンバーです。初期値250

Lots:ロット数です。初期値0.1

StopLoss:損切の値です。初期値40

TakeProfit:利確の値です。初期値30

Slippage:許容スリッページです。初期値5

COMMENT:エントリー名です。初期値Slinky3.0

Max_Spread:スプレッドフィルターです。初期値2.0

close:決済ロジックのON/OFFです。初期false

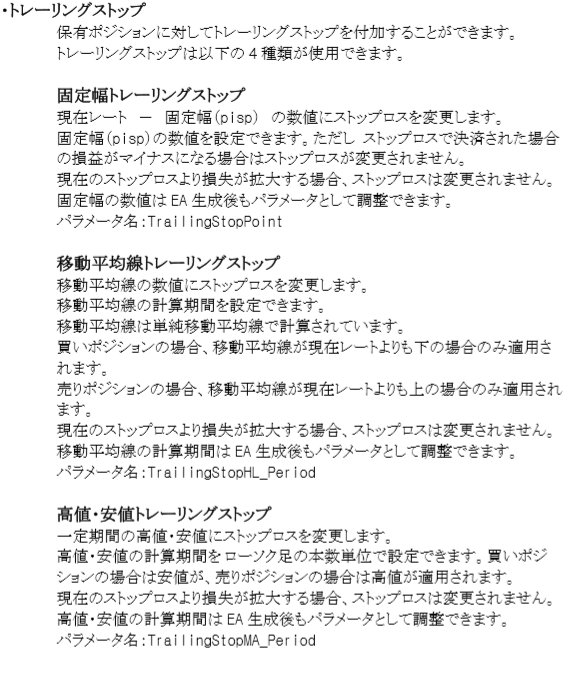

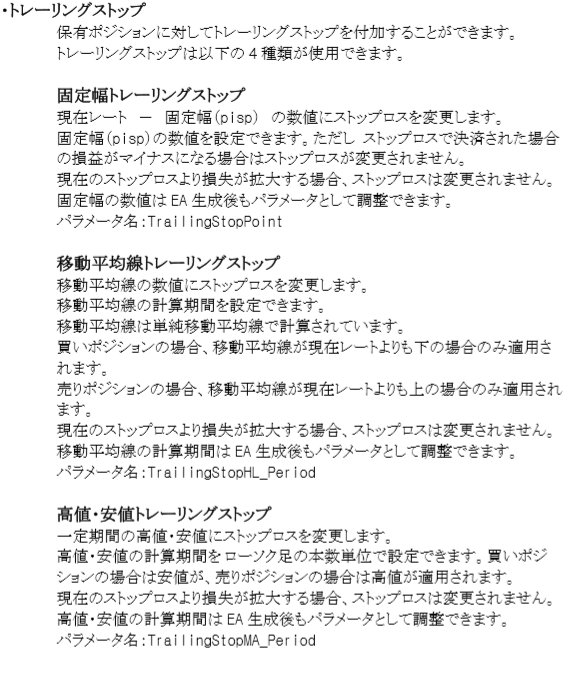

TrailingStop:トレールのON/OFFです。初期false

TrailingStopMA:トレールのON/OFFです。初期false

TrailingStopHL:トレールのON/OFFです。初期false

TrailingStopATR:トレールのON/OFFです。初期false

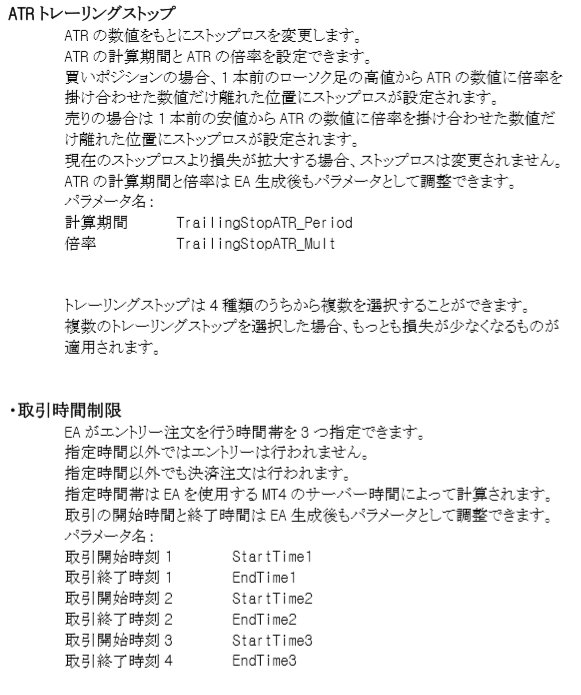

(トレーリングストップ機能については下記に資料を添付しています)

Band_Period:ボリンジャーバンドの計算期間です。初期値25

Band_Deviation:ボリンジャーバンドのセンターラインからの偏差です。初期値2

Band_Slide:バンドの位置です。数値を入れるとバンド位置が右へずれる事になります。初期値0

Band_Shift:バンドを参照するローソク足の位置です。1で1本前の足、2で2ほんまえの足のバンドを参照します。

Candle_Stick_Shift:ローソク足の位置の指定です。0で最新1で1本前の足、2で2本前の足を参照します。

(上記のロジック関係のパラメーターは1~4がエントリーロジック用5~6が決済ロジック用となっております。)

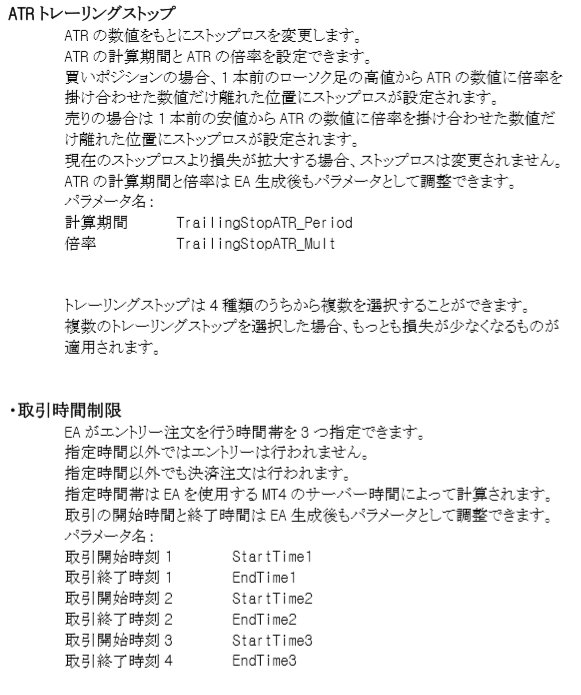

StartTime1~3:エントリー時間制限のスタートです。初期値0:00

EndTime1~3:エントリー時間制限の終了時間です。初期値2:00

MaxPositionCount:最大エントリー数です。初期値1

本当はもっと後(実運用しているのでフォワード実績を見てから)で出品しようと考えていたのですが、「1度出品を経験してみたい!」欲求に勝てずに出品してみました。

自分が作成したEAが1本でも世に出ていったら嬉しいなと思います。

上記は2004年から2020年1月までのバックテスト結果チャートとなっております。

通貨制限・時間軸制限無しのパラメーターは全部開放の為、ほかにどのような通貨ペア・時間軸に通用するかはわかりませんがそれを見つける楽しみがあるEAだと思います。

EAの設置に関する部分や、どの証券会社で使用できるか?最適化の方法等を質問いただいても即時回答が難しい為、初心者が手を出しずらい相場より高めの価格で出品させていただきました。

既にEA運用にて利益が出ていて余裕のある、検証やセッティングが好きな方に色々いじって遊んでいただけたら幸いです。

ロジックはボリンジャーバンドを使用した逆張りで、極簡単なものとなっております。

内部決済ロジックは入れておらず、TP/SLを指定して決済するタイプとなっております。(Ver3.0にて内部決済ロジックを導入しました。ON/OFF可能です)

両建てはしない仕様となっております。初期では1ポジのスイングトレードEAのような感じです。

最適化は行っておらず、1回目でそこそこの右肩上がりになっていたのでエントリー時間制限(パラメーターにて3分割調整可能)を行い、今の状態にしております。

年間取引数がUSD/JPYのM15ですと平均で100回前後となっており、多頻度エントリーではありません。

ボリンジャーバンドで参照する時間軸は固定しておらず、セットしたチャート次第ですので選んだ通貨ペア・時間軸次第でエントリー回数も変わってきます。

ここからパラメーターの説明を書きます。

MAGIC1:マジックナンバーです。初期値250

Lots:ロット数です。初期値0.1

StopLoss:損切の値です。初期値40

TakeProfit:利確の値です。初期値30

Slippage:許容スリッページです。初期値5

COMMENT:エントリー名です。初期値Slinky3.0

Max_Spread:スプレッドフィルターです。初期値2.0

close:決済ロジックのON/OFFです。初期false

TrailingStop:トレールのON/OFFです。初期false

TrailingStopMA:トレールのON/OFFです。初期false

TrailingStopHL:トレールのON/OFFです。初期false

TrailingStopATR:トレールのON/OFFです。初期false

(トレーリングストップ機能については下記に資料を添付しています)

Band_Period:ボリンジャーバンドの計算期間です。初期値25

Band_Deviation:ボリンジャーバンドのセンターラインからの偏差です。初期値2

Band_Slide:バンドの位置です。数値を入れるとバンド位置が右へずれる事になります。初期値0

Band_Shift:バンドを参照するローソク足の位置です。1で1本前の足、2で2ほんまえの足のバンドを参照します。

Candle_Stick_Shift:ローソク足の位置の指定です。0で最新1で1本前の足、2で2本前の足を参照します。

(上記のロジック関係のパラメーターは1~4がエントリーロジック用5~6が決済ロジック用となっております。)

StartTime1~3:エントリー時間制限のスタートです。初期値0:00

EndTime1~3:エントリー時間制限の終了時間です。初期値2:00

MaxPositionCount:最大エントリー数です。初期値1

本当はもっと後(実運用しているのでフォワード実績を見てから)で出品しようと考えていたのですが、「1度出品を経験してみたい!」欲求に勝てずに出品してみました。

自分が作成したEAが1本でも世に出ていったら嬉しいなと思います。

決してバケモノEAではなく、平凡な数値かと思いますが悪くは無いです。

決してバケモノEAではなく、平凡な数値かと思いますが悪くは無いです。

2004年~2020年で2005年のみ年間マイナスで終わっております。

上記はあくまでも初期設定でUSD/JPYのM15チャートで稼働させた場合となっております。

初心者の方は購入されないとは思いますが、設置するチャート次第で全然違う結果になってしまいますのでご注意ください。

Ver.3.0にて4種類のトレーリングストップ機能と内部決済ロジックを組み込みました。

トレーリングは4種類独立でON/OFF可能としています。

内部決済ロジックもON/OFF可能とし初期パラメーターは全部OFFとしております。

そのためゴゴジャンフォワードでは初期型Slinkyのまま計測されていきます。

Ver.4.0にて売りと買いのエントリーを個別にON/OFFできる機能をパラメーターに追加しました。

これにより、より一層の成績アップ・仕様の多様性が出ると思います。

トレーリングストップの概要説明を下記に添付します。

2004年~2020年で2005年のみ年間マイナスで終わっております。

上記はあくまでも初期設定でUSD/JPYのM15チャートで稼働させた場合となっております。

初心者の方は購入されないとは思いますが、設置するチャート次第で全然違う結果になってしまいますのでご注意ください。

Ver.3.0にて4種類のトレーリングストップ機能と内部決済ロジックを組み込みました。

トレーリングは4種類独立でON/OFF可能としています。

内部決済ロジックもON/OFF可能とし初期パラメーターは全部OFFとしております。

そのためゴゴジャンフォワードでは初期型Slinkyのまま計測されていきます。

Ver.4.0にて売りと買いのエントリーを個別にON/OFFできる機能をパラメーターに追加しました。

これにより、より一層の成績アップ・仕様の多様性が出ると思います。

トレーリングストップの概要説明を下記に添付します。

出品時~11月現在の当方の環境でのバックテストグラフです。

出品時~11月現在の当方の環境でのバックテストグラフです。

ゴゴジャンフォワードとの乖離が大きいので、そこの差がなんなのか?を考え中です。

ゴゴジャンフォワードとの乖離が大きいので、そこの差がなんなのか?を考え中です。

上記は2004年から2020年1月までのバックテスト結果チャートとなっております。

通貨制限・時間軸制限無しのパラメーターは全部開放の為、ほかにどのような通貨ペア・時間軸に通用するかはわかりませんがそれを見つける楽しみがあるEAだと思います。

EAの設置に関する部分や、どの証券会社で使用できるか?最適化の方法等を質問いただいても即時回答が難しい為、初心者が手を出しずらい相場より高めの価格で出品させていただきました。

既にEA運用にて利益が出ていて余裕のある、検証やセッティングが好きな方に色々いじって遊んでいただけたら幸いです。

ロジックはボリンジャーバンドを使用した逆張りで、極簡単なものとなっております。

内部決済ロジックは入れておらず、TP/SLを指定して決済するタイプとなっております。(Ver3.0にて内部決済ロジックを導入しました。ON/OFF可能です)

両建てはしない仕様となっております。初期では1ポジのスイングトレードEAのような感じです。

最適化は行っておらず、1回目でそこそこの右肩上がりになっていたのでエントリー時間制限(パラメーターにて3分割調整可能)を行い、今の状態にしております。

年間取引数がUSD/JPYのM15ですと平均で100回前後となっており、多頻度エントリーではありません。

ボリンジャーバンドで参照する時間軸は固定しておらず、セットしたチャート次第ですので選んだ通貨ペア・時間軸次第でエントリー回数も変わってきます。

ここからパラメーターの説明を書きます。

MAGIC1:マジックナンバーです。初期値250

Lots:ロット数です。初期値0.1

StopLoss:損切の値です。初期値40

TakeProfit:利確の値です。初期値30

Slippage:許容スリッページです。初期値5

COMMENT:エントリー名です。初期値Slinky3.0

Max_Spread:スプレッドフィルターです。初期値2.0

close:決済ロジックのON/OFFです。初期false

TrailingStop:トレールのON/OFFです。初期false

TrailingStopMA:トレールのON/OFFです。初期false

TrailingStopHL:トレールのON/OFFです。初期false

TrailingStopATR:トレールのON/OFFです。初期false

(トレーリングストップ機能については下記に資料を添付しています)

Band_Period:ボリンジャーバンドの計算期間です。初期値25

Band_Deviation:ボリンジャーバンドのセンターラインからの偏差です。初期値2

Band_Slide:バンドの位置です。数値を入れるとバンド位置が右へずれる事になります。初期値0

Band_Shift:バンドを参照するローソク足の位置です。1で1本前の足、2で2ほんまえの足のバンドを参照します。

Candle_Stick_Shift:ローソク足の位置の指定です。0で最新1で1本前の足、2で2本前の足を参照します。

(上記のロジック関係のパラメーターは1~4がエントリーロジック用5~6が決済ロジック用となっております。)

StartTime1~3:エントリー時間制限のスタートです。初期値0:00

EndTime1~3:エントリー時間制限の終了時間です。初期値2:00

MaxPositionCount:最大エントリー数です。初期値1

本当はもっと後(実運用しているのでフォワード実績を見てから)で出品しようと考えていたのですが、「1度出品を経験してみたい!」欲求に勝てずに出品してみました。

自分が作成したEAが1本でも世に出ていったら嬉しいなと思います。

上記は2004年から2020年1月までのバックテスト結果チャートとなっております。

通貨制限・時間軸制限無しのパラメーターは全部開放の為、ほかにどのような通貨ペア・時間軸に通用するかはわかりませんがそれを見つける楽しみがあるEAだと思います。

EAの設置に関する部分や、どの証券会社で使用できるか?最適化の方法等を質問いただいても即時回答が難しい為、初心者が手を出しずらい相場より高めの価格で出品させていただきました。

既にEA運用にて利益が出ていて余裕のある、検証やセッティングが好きな方に色々いじって遊んでいただけたら幸いです。

ロジックはボリンジャーバンドを使用した逆張りで、極簡単なものとなっております。

内部決済ロジックは入れておらず、TP/SLを指定して決済するタイプとなっております。(Ver3.0にて内部決済ロジックを導入しました。ON/OFF可能です)

両建てはしない仕様となっております。初期では1ポジのスイングトレードEAのような感じです。

最適化は行っておらず、1回目でそこそこの右肩上がりになっていたのでエントリー時間制限(パラメーターにて3分割調整可能)を行い、今の状態にしております。

年間取引数がUSD/JPYのM15ですと平均で100回前後となっており、多頻度エントリーではありません。

ボリンジャーバンドで参照する時間軸は固定しておらず、セットしたチャート次第ですので選んだ通貨ペア・時間軸次第でエントリー回数も変わってきます。

ここからパラメーターの説明を書きます。

MAGIC1:マジックナンバーです。初期値250

Lots:ロット数です。初期値0.1

StopLoss:損切の値です。初期値40

TakeProfit:利確の値です。初期値30

Slippage:許容スリッページです。初期値5

COMMENT:エントリー名です。初期値Slinky3.0

Max_Spread:スプレッドフィルターです。初期値2.0

close:決済ロジックのON/OFFです。初期false

TrailingStop:トレールのON/OFFです。初期false

TrailingStopMA:トレールのON/OFFです。初期false

TrailingStopHL:トレールのON/OFFです。初期false

TrailingStopATR:トレールのON/OFFです。初期false

(トレーリングストップ機能については下記に資料を添付しています)

Band_Period:ボリンジャーバンドの計算期間です。初期値25

Band_Deviation:ボリンジャーバンドのセンターラインからの偏差です。初期値2

Band_Slide:バンドの位置です。数値を入れるとバンド位置が右へずれる事になります。初期値0

Band_Shift:バンドを参照するローソク足の位置です。1で1本前の足、2で2ほんまえの足のバンドを参照します。

Candle_Stick_Shift:ローソク足の位置の指定です。0で最新1で1本前の足、2で2本前の足を参照します。

(上記のロジック関係のパラメーターは1~4がエントリーロジック用5~6が決済ロジック用となっております。)

StartTime1~3:エントリー時間制限のスタートです。初期値0:00

EndTime1~3:エントリー時間制限の終了時間です。初期値2:00

MaxPositionCount:最大エントリー数です。初期値1

本当はもっと後(実運用しているのでフォワード実績を見てから)で出品しようと考えていたのですが、「1度出品を経験してみたい!」欲求に勝てずに出品してみました。

自分が作成したEAが1本でも世に出ていったら嬉しいなと思います。

決してバケモノEAではなく、平凡な数値かと思いますが悪くは無いです。

決してバケモノEAではなく、平凡な数値かと思いますが悪くは無いです。

2004年~2020年で2005年のみ年間マイナスで終わっております。

上記はあくまでも初期設定でUSD/JPYのM15チャートで稼働させた場合となっております。

初心者の方は購入されないとは思いますが、設置するチャート次第で全然違う結果になってしまいますのでご注意ください。

Ver.3.0にて4種類のトレーリングストップ機能と内部決済ロジックを組み込みました。

トレーリングは4種類独立でON/OFF可能としています。

内部決済ロジックもON/OFF可能とし初期パラメーターは全部OFFとしております。

そのためゴゴジャンフォワードでは初期型Slinkyのまま計測されていきます。

Ver.4.0にて売りと買いのエントリーを個別にON/OFFできる機能をパラメーターに追加しました。

これにより、より一層の成績アップ・仕様の多様性が出ると思います。

トレーリングストップの概要説明を下記に添付します。

2004年~2020年で2005年のみ年間マイナスで終わっております。

上記はあくまでも初期設定でUSD/JPYのM15チャートで稼働させた場合となっております。

初心者の方は購入されないとは思いますが、設置するチャート次第で全然違う結果になってしまいますのでご注意ください。

Ver.3.0にて4種類のトレーリングストップ機能と内部決済ロジックを組み込みました。

トレーリングは4種類独立でON/OFF可能としています。

内部決済ロジックもON/OFF可能とし初期パラメーターは全部OFFとしております。

そのためゴゴジャンフォワードでは初期型Slinkyのまま計測されていきます。

Ver.4.0にて売りと買いのエントリーを個別にON/OFFできる機能をパラメーターに追加しました。

これにより、より一層の成績アップ・仕様の多様性が出ると思います。

トレーリングストップの概要説明を下記に添付します。

出品時~11月現在の当方の環境でのバックテストグラフです。

出品時~11月現在の当方の環境でのバックテストグラフです。

ゴゴジャンフォワードとの乖離が大きいので、そこの差がなんなのか?を考え中です。

ゴゴジャンフォワードとの乖離が大きいので、そこの差がなんなのか?を考え中です。REAL TRADE

フォワードテスト

バックテスト

FX自動売買について

FX自動売買(MT4EA)とは

FX自動売買とは、予め取引ルールと決済ルールを組み込んだ、プログラミングによる自動売買のことを言います。自動売買をする方法は色々ありますが、GogoJungleではMT4というトレードプラットフォーム上で稼働するExperts Adviors(以下EA)を取り扱っています。

FX自動売買の取引タイプ

MT4で使うEAには色々な取引タイプのEAがあります。

裁量トレードと同じように、インジケーターを組み合わせて取引タイミングや決済タイミングを決めるもの、一定の価格(pips)間隔で買いや売りを繰り返すもの、相場のアノマリーや時間的特徴を利用した取引手法など、その種類は裁量トレードの手法と同じく豊富です。

簡単に分類すると、

・スキャルピング(数分~数時間以内で取引が完了するタイプ)、

・デイトレード(数時間~1日程度で取引が完了するタイプ)、

・スイング(1日以上~1週間程度の比較的長い期間をかけて取引を行うタイプ)

・ナンピン・マーチン(等間隔または不等間隔で複数のポジションを持ち、利益が出たら一括で決済をするタイプ。ロット数を段階的に上げていくものをマーチンゲールといいます。)

・アノマリーEA(仲値トレード、早朝スキャルピング)

などがあります。

裁量トレードと同じように、インジケーターを組み合わせて取引タイミングや決済タイミングを決めるもの、一定の価格(pips)間隔で買いや売りを繰り返すもの、相場のアノマリーや時間的特徴を利用した取引手法など、その種類は裁量トレードの手法と同じく豊富です。

簡単に分類すると、

・スキャルピング(数分~数時間以内で取引が完了するタイプ)、

・デイトレード(数時間~1日程度で取引が完了するタイプ)、

・スイング(1日以上~1週間程度の比較的長い期間をかけて取引を行うタイプ)

・ナンピン・マーチン(等間隔または不等間隔で複数のポジションを持ち、利益が出たら一括で決済をするタイプ。ロット数を段階的に上げていくものをマーチンゲールといいます。)

・アノマリーEA(仲値トレード、早朝スキャルピング)

などがあります。

FX自動売買のリスクとメリット・デメリット

FXを行う以上、裁量トレードと同じように自動売買にもリスクは存在します。

ただし、自動売買は予めリスクを限定できる、予想できるということが大きな強みでもあります。

【リスク】

FX取引をする以上は取引リスクは自動売買にももちろん存在します。

・ロットサイズのリスク

勝率が高いからといってロットを無理に大きくすると、EAによってはまれに負けた時の損失Pipsが大きい場合があります。必ずSLのPipsや保有ポジション数を確認してから、適切なロットで運用しましょう。

・急激な相場変動リスク

指標発表や、突発的なニュースによって急激に相場が動くケースがあります。システムトレードはそのような予測できない相場の動きを想定していないため、事前に決済しておく、取引しないなどの判断が出来ません。対策としては指標発表やVIX(恐怖指数)でEAの停止を行うツールなどを使うことも可能です。

【メリット】

・24時間取引してくれる

システムトレードはあなたの代わりに取引できるチャンスがあれば、淡々とトレードを行ってくれます。トレードに時間を割けない方にとってはとても便利な武器になってくれるでしょう。

・感情にコントロールされることなく淡々とトレードしてくれる

裁量トレードで負けが続き、ロットを大きくしてみたり、逆に少ない利益ですぐに利確してしまうといった、人間にありがちなルールの自己都合化がありません。

・初心者でも始められる

FX取引を行うにはまず勉強から…といった必要がなく、誰が使っても同じ結果になるのがシステムトレードです。

【デメリット】

・取引頻度を自由に増やせない

システムトレードは予めプログラムされた条件通りに取引をするため、EAのタイプによっては月に何度かしか取引をしない場合もあります。

・相場に合う、合わないがある

EAの取引タイプによって、順張りに向いている時期、逆張りに向いている時期などがあるため、すべての期間において成績が一定になることは少ないです。去年は良かったが、今年はあまり成績が振るわないということもあるため、運用する時期なのかどうかをある程度裁量で判断する必要があります。

ただし、自動売買は予めリスクを限定できる、予想できるということが大きな強みでもあります。

【リスク】

FX取引をする以上は取引リスクは自動売買にももちろん存在します。

・ロットサイズのリスク

勝率が高いからといってロットを無理に大きくすると、EAによってはまれに負けた時の損失Pipsが大きい場合があります。必ずSLのPipsや保有ポジション数を確認してから、適切なロットで運用しましょう。

・急激な相場変動リスク

指標発表や、突発的なニュースによって急激に相場が動くケースがあります。システムトレードはそのような予測できない相場の動きを想定していないため、事前に決済しておく、取引しないなどの判断が出来ません。対策としては指標発表やVIX(恐怖指数)でEAの停止を行うツールなどを使うことも可能です。

【メリット】

・24時間取引してくれる

システムトレードはあなたの代わりに取引できるチャンスがあれば、淡々とトレードを行ってくれます。トレードに時間を割けない方にとってはとても便利な武器になってくれるでしょう。

・感情にコントロールされることなく淡々とトレードしてくれる

裁量トレードで負けが続き、ロットを大きくしてみたり、逆に少ない利益ですぐに利確してしまうといった、人間にありがちなルールの自己都合化がありません。

・初心者でも始められる

FX取引を行うにはまず勉強から…といった必要がなく、誰が使っても同じ結果になるのがシステムトレードです。

【デメリット】

・取引頻度を自由に増やせない

システムトレードは予めプログラムされた条件通りに取引をするため、EAのタイプによっては月に何度かしか取引をしない場合もあります。

・相場に合う、合わないがある

EAの取引タイプによって、順張りに向いている時期、逆張りに向いている時期などがあるため、すべての期間において成績が一定になることは少ないです。去年は良かったが、今年はあまり成績が振るわないということもあるため、運用する時期なのかどうかをある程度裁量で判断する必要があります。

自動売買運用に必要な設備と環境

MT4上で自動売買(EA)を運用するのに必要なものは以下の通りです。

・MT4(MetaTrader4。MT4が使えるFX会社で口座開設をする必要があります)

・EA(自動売買用プログラム)

・EAを運用するのに必要な運用資金

・24時間稼働可能なPCまたはVPS(クラウドサーバー上に仮想PCを置き、そこでMT4を立ち上げておく)

・MT4(MetaTrader4。MT4が使えるFX会社で口座開設をする必要があります)

・EA(自動売買用プログラム)

・EAを運用するのに必要な運用資金

・24時間稼働可能なPCまたはVPS(クラウドサーバー上に仮想PCを置き、そこでMT4を立ち上げておく)

MT4のインストール及び口座ログイン

MT4は、MT4が利用できるFX会社で口座開設すると、そのFX会社のMT4として利用できるようになります。MT4はパソコン上にインストールして使う、スタンドアロンタイプのソフトウェアですので、口座開設したFX会社のサイト上からプログラムファイルをダウンロードしてきてパソコンにインストールを行います。

また、口座にはデモ口座とリアル口座があり、デモ口座を申請すると仮想の資金でトレードを体験することができます。リアル口座を開設したあと、FX会社から割り振られた接続サーバーを選択し、パスワードを入力して口座にログインします。

FX会社に指定された方法で口座資金を入金すると、MT4口座に資金が反映されて取引ができるようになります。

また、口座にはデモ口座とリアル口座があり、デモ口座を申請すると仮想の資金でトレードを体験することができます。リアル口座を開設したあと、FX会社から割り振られた接続サーバーを選択し、パスワードを入力して口座にログインします。

FX会社に指定された方法で口座資金を入金すると、MT4口座に資金が反映されて取引ができるようになります。

MT4へのEAの設置方法

ここではGogoJungleでEAを購入した場合の設定方法について説明いたします。

まず、購入したEAファイルをGogoJungleのマイページからDLします。zip(圧縮)ファイルがDLされるので、右クリックで解凍して中の「◯◯◯(EA名称)_A19GAw09(任意の8英数字).ex4」というファイルを取り出します。

次に、MT4を立ち上げ、「ファイル」→「データフォルダを開く」→「MQL4」→「Experts」フォルダーの中に、ex4ファイルを入れます。MT4を一度閉じ、再起動したら、上部メニューの「ツール」→「オプション」の「エキスパートアドバイザー」の「自動売買を許可する」、「DLLの使用を許可する」にチェックを入れてOKを押して閉じます。

EAの正しい運用に必要な通貨ペアと時間足がEA販売ページに書いてあるので、それを参照して正しい通貨ペアの時間足のチャートを開きます(例:USDJPY5M ドル円5分足)。

メニューのナビゲーター内、「エキスパートアドバイザ」に先ほど入れたEAファイル名があるので、クリックして選択し、そのままドラッグ&ドロップでチャート内にEAを載せます。EA名ダブルクリックでも、選択されているチャートに載せることができます。

チャート上の左上に、「Authentification Success」と出れば認証成功です。 EAの運用には、24時間PCを立ち上げて置く必要がありますので、自動スリープ機能を解除するか、VPS上にMT4を置いてEAを運用ください。

まず、購入したEAファイルをGogoJungleのマイページからDLします。zip(圧縮)ファイルがDLされるので、右クリックで解凍して中の「◯◯◯(EA名称)_A19GAw09(任意の8英数字).ex4」というファイルを取り出します。

次に、MT4を立ち上げ、「ファイル」→「データフォルダを開く」→「MQL4」→「Experts」フォルダーの中に、ex4ファイルを入れます。MT4を一度閉じ、再起動したら、上部メニューの「ツール」→「オプション」の「エキスパートアドバイザー」の「自動売買を許可する」、「DLLの使用を許可する」にチェックを入れてOKを押して閉じます。

EAの正しい運用に必要な通貨ペアと時間足がEA販売ページに書いてあるので、それを参照して正しい通貨ペアの時間足のチャートを開きます(例:USDJPY5M ドル円5分足)。

メニューのナビゲーター内、「エキスパートアドバイザ」に先ほど入れたEAファイル名があるので、クリックして選択し、そのままドラッグ&ドロップでチャート内にEAを載せます。EA名ダブルクリックでも、選択されているチャートに載せることができます。

チャート上の左上に、「Authentification Success」と出れば認証成功です。 EAの運用には、24時間PCを立ち上げて置く必要がありますので、自動スリープ機能を解除するか、VPS上にMT4を置いてEAを運用ください。

利用する口座を変更したい場合

GogoJungleのEAは1EAにつき、1リアル口座、1デモ口座でご利用いただけます。

認証されている口座以外で利用したい場合は、登録口座をリセットする必要があります。

口座のリセット方法は、Web認証が登録されているMT4を閉じている状態で、

GogoJungleのマイページ>利用する>デジタルコンテンツ>該当のEA>登録番号の「リセット」ボタンを押すと、登録口座が解除されます。

口座がリセットされている状態で、他のMT4口座でEAを利用すると、新たに口座が登録されます。

また、口座のリセットは無制限に行っていただけます。

認証されている口座以外で利用したい場合は、登録口座をリセットする必要があります。

口座のリセット方法は、Web認証が登録されているMT4を閉じている状態で、

GogoJungleのマイページ>利用する>デジタルコンテンツ>該当のEA>登録番号の「リセット」ボタンを押すと、登録口座が解除されます。

口座がリセットされている状態で、他のMT4口座でEAを利用すると、新たに口座が登録されます。

また、口座のリセットは無制限に行っていただけます。

上手くいかない場合の対処法

Web認証でエラーがでる、GogoJungleのフォワード実績ページでは取引しているのに自分の口座では取引しない、といった場合は、様々な原因が考えられますのでより詳しくは以下をご参照ください。

→ EAが動かない時にチェックする項目

→ EAが動かない時にチェックする項目

取引ロットの大きさについて

FX取引でのロットの大きさは、通常、

1ロット=10万通貨

0.1ロット=1万通貨

0.01ロット=1000通貨

となります。

ドル円であれば1ロット=10万ドルを保有することになります。

ロット保有にかかる証拠金はFX会社の定めるレバレッジによって決まります。

レバレッジ25倍であれば、1万通貨のドル円を保有するのに必要な証拠金は 10000*109(※1ドル109円レート時)÷25 = 43,600円 となります。

1ロット=10万通貨

0.1ロット=1万通貨

0.01ロット=1000通貨

となります。

ドル円であれば1ロット=10万ドルを保有することになります。

ロット保有にかかる証拠金はFX会社の定めるレバレッジによって決まります。

レバレッジ25倍であれば、1万通貨のドル円を保有するのに必要な証拠金は 10000*109(※1ドル109円レート時)÷25 = 43,600円 となります。

システムトレード用語集

・プロフィットファクター:総利益÷総損失

・リスクリターン率:期間中損益の合計÷最大ドローダウン

・最大ドローダウン:運用期間中の最大含み損

・最大ポジション数:そのEAが理論上同時に持ちうる最大のポジション数です

・TP(Take Profit):EAの設定上の利確Pips(または指定された金額など)

・SL(Stop Loss):EAの設定上の最大損失pips(または指定された金額など)

・トレーリングストップ:決済を指定のPipsで行うのではなく、一定の利益が出たら決済SLを一定の間隔で引き上げて(利益の方向へ)行く、利益を最大化する決済方法です。

・リスクリワード率(ペイオフレシオ):平均利益÷平均損失

・両建て:買いと売りを同時に保有すること(一部のFX会社では両建て不可のタイプもあります)

・リスクリターン率:期間中損益の合計÷最大ドローダウン

・最大ドローダウン:運用期間中の最大含み損

・最大ポジション数:そのEAが理論上同時に持ちうる最大のポジション数です

・TP(Take Profit):EAの設定上の利確Pips(または指定された金額など)

・SL(Stop Loss):EAの設定上の最大損失pips(または指定された金額など)

・トレーリングストップ:決済を指定のPipsで行うのではなく、一定の利益が出たら決済SLを一定の間隔で引き上げて(利益の方向へ)行く、利益を最大化する決済方法です。

・リスクリワード率(ペイオフレシオ):平均利益÷平均損失

・両建て:買いと売りを同時に保有すること(一部のFX会社では両建て不可のタイプもあります)

人気商品

特定商取引法に基づく表示

会社名

株式会社ゴゴジャン

運営統括責任者

早川忍

郵便番号

〒113-0033

所在地

東京都文京区本郷3-6-6 本郷OGIビル6F

お問い合わせ

お問い合わせページよりお願い致します。

電話番号

03-5844-6090

営業日

月曜日~金曜日

営業時間

10:00~19:00

販売商品・サービス

セミナーのリアルタイム動画配信サービス・動画配信サービス、対面式セミナー、電子書籍、ソフトウェア、シグナル配信、セミナーのビデオ

※セミナーのリアルタイム動画配信サービスとは、セミナー実施時に即時弊社サーバーより配信するサービスです。

※セミナーの動画配信サービスとは、保存されたセミナー動画を弊社サーバーより配信するサービスです。

※セミナーのビデオとは、保存されたセミナー動画をお客様のPCにダウンロードするサービスです。

販売価格

各商品の販売価格は、商品ページにて税込価格で表示しております。

商品の発送方法、ご提供方法

オンライン上でのダウンロード、または配信

ホームページURL

https://www.gogojungle.co.jp/

商品の発送時期、 ご提供時期

原則として弊社によるお客様のご入金完了後即ご提供いたします。

商品代金以外の必要料金

銀行振り込みご利用の場合は、商品代金(税込表示)に加えて振り込み手数料がかかります。

ご注文方法

ホームページ上の専用申込フォームよりご注文ください。

お支払い方法

銀行振込 / クレジットカード決済/ Web口座振替/ コンビニ決済

ファミリーマートでのお支払い方法

デイリーヤマザキ・ヤマザキデイリーストアーでのお支払い方法

お支払い期限

お申込み日から2日以上経つ場合、お申込をキャンセルさせていただきます。予めご了承ください。

商品注文後のキャンセルについて

1.セミナーのリアルタイム動画配信サービス、動画配信サービスは配信実施24時間前以降のキャンセルはお受けいたしておりません。ご返金対応ができませんので十分ご注意ください。

2.対面式セミナーは、開催の3営業日前以降のキャンセルおよびご返金はお受けいたしておりません。

3.電子書籍、ソフトウェア、ビデオは、著作権保護の観点からお客様のダウンロード実施、または購読開始以降はキャンセルできません。ご返金対応ができません。予めご了承ください。

ご返金にかかる費用

お客様のご都合によるご返金は、銀行振込・コンビニ決済・Web口座振替の場合振込手数料がすべてお客様負担となります。

カード決済ご利用の場合手数料は生じません。あらかじめご了承ください。

注意点

当ページに記載する「発送方法、ご提供方法」「発送時期、 ご提供時期」「代金以外の必要料金」「注文方法」「お支払い方法・期限」

「商品注文後のキャンセル」「返金にかかる費用」の各項目はGogoJungleで販売する全ての商品に適用されますが、商品毎にご案内がある場合は、

商品毎に記載いたします。

GogoJungleが販売者である場合は、商品ページにGogoJungleの「特定商取引に関する法律」に基づく表記を行ないます。

出品者が販売者であり、且つ出品者が「事業者」である場合は、出品者の「特定商取引に関する法律」に基づく表記を行ないます。

出品者が「事業者」に該当するかは出品者の判断によります。ただし、 経済産業省 特定商取引法の通達の改正について

「インターネット・オークションにおける「販売業者」に係るガイドライン」

https://www.caa.go.jp/policies/policy/consumer_transaction/amendment/2016/pdf/amendment_171206_0001.pdf

を鑑み「事業者」であることが明らかな出品者については、「事業者」として扱い開示請求があった場合は迅速に対応します。