ランド円自分年金戦略EA

คำถาม(30)

- ทุกช่วงเวลา

- 2 ปี

- 1 ปี

- 6 เดือน

- 3 เดือน

- 1 เดือน

Profit

:

323,437¥Profit Factor

:

1.89Rate of return risk

?

:

0.53Average Profit

:

1,095¥Average Loss

:

-18,260¥Balance

?

:

1,323,437¥Rate of return (all periods)?

:

26.26%Win Rate

:

96.93%

(379/391)

Maximum Position

?

:

18Maximum drawdown

?

:

43.48%

(615,835¥)

Maximum Profit

:

10,000¥Maximum Loss

:

-28,650¥Recommended Margin

?

:

1,231,670¥Unrealized P/L

:

-140,095¥Deposit

?

:

1,000,000¥Currency

:

JPY- Account

โบรกเกอร์ที่ใช้งานได้

ใช้ได้กับโบรกเกอร์ที่รองรับ MT4

Forward testing (Profit)

ข้อมูลสินค้า

คอมมูนิตี้

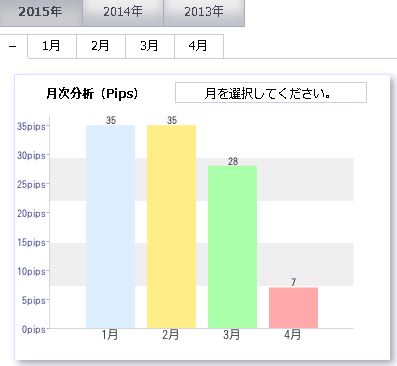

รายละเอียดสถิติ (รายเดือน)

2025

2024

2023

2022

2021

- ม.ค.

- ก.พ.

- มี.ค.

- เม.ย.

- พ.ค.

- มิ.ย.

- ก.ค.

- ส.ค.

- ก.ย.

- ต.ค.

- พ.ย.

- ธ.ค.

ไม่มีข้อมูล

ปฏิทินการเทรดของเดือนนี้

เกี่ยวกับกลยุทธ์

คู่สกุลเงิน

[ZAR/JPY]

Maximum position

11

Maximum Lot

0

Timeframe

M1

Maximum stop loss

0

Take profit

7

Cross Order

ไม่มี

~唯一許される損切りなしトレード~

*ランド円自分年金戦略EA_V2はロットを自動計算してくれるものとして、現在出品されています

ランド円自分年金戦略EA

~唯一許される損切りなしトレード~

*ランド円自分年金戦略EA_V2はロットを自動計算してくれるものとして、現在出品されています

ランド円自分年金戦略EA

まずこの簡単な理屈を理解されているでしょうか?

ランド円「11万円を10.0の時に1万通貨で買いエントリー」した場合、

9.00まで下がれば含み損-1万円。

5.00まで下がれば含み損-5万円。

0円まで下がれば含み損-10万円

0円まで下がったとしても、もうそれ以上含み損が大きくなりません!

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

つまり「11万円を10.0の時に1万通貨で買いエントリー」した場合、

損切りなしトレードは「可能」と言えるのではないでしょうか??

経験者にはわかり切ったことかも知れませんが、

資金管理さえ出来ればランド円は「損切りなしトレード」が可能なんです。

*もちろんそんな単純なEAではありません。

この理屈他の通貨でも当てはまりますが、ランド円はスワップがきっちり毎日つくというのと、10.00からならば「たったの-1000pips」までの範囲で考えればよいという利点があります。

ロット表を用意しましたので、どこでエントリーする時に、どれくらいのロットまでなら大丈夫か?というのが一目で分かります。

もちろん単純に、そのロットでその時エントリーして放置すればスワップは貯まりますが、高値でエントリーした場合かなり長い間含み損が解消されないままになり精神衛生上よくありません。

そのような「レバレッジ」や「エントリー」のことを総合的に考え、息の長いトレードをするEAとその戦略についてまとめました。

もう一度断っておきますが、これは長い目での運用を目指したものなので利益率はたいしたことありません。EAだけだと月利1%以下もあります。(利益率アップ戦略をものにすれば違いますがそれは裁量を要します)

しかし、きっと10年後もFX-ONが続いていればコツコツと利益を出しています。

なぜなら0円まで下落しても「強制ロスカット」されないロットだからです。

そしてこの実績、含み損も持っていますが、その含み損にはスワップが貯まっていっています。

■仕組み

■EAの概要

•RSIが低い時だけエントリー

•損切りなしの買いのみのエントリー

•ポジション制限10コまで

■資金・ロット表

あなたの投資する資金にあった、国内口座で想定した計算表を付けました。

含み損抱えても×円まで下落しても崩壊しない取引をすればいいのです。

(一応マニュアルでは「0円までの下落」「5円までの下落」、「7円までの下落」で数値を出しています。自己責任で選んでいただきロットを決定してください)

(7.76がリーマンショック後の最安値)

■中級者用、利益アップ戦略

仕組みや考えを完全に理解出来ている方は、ここへ進んでいただければと思います。

EAだけですと利益が少なすぎる、と必ず思うはずですので。

利益アップのための秘策は、「あるルールに基づいたピラミッディング」です。

10コのうちの1つのポジションはRSIが低い時に発動されます。

そのポジションを皮切りに、ルールに基づいたピラミッディングをすることで、

高値の時に利益が発生しないという事態を防ぎ、かつ年利を高くすることが目的です。

特別レポートを用意しましたので、それに基づいて自動売買に裁量を加えてやるということとなります。

開発者がやっている方法を載せますので、それを元にご自身の判断でできる方のみ実行してください。

■商品概要

・自分年金戦略EA

・FX-ON様のセキュリティファイル

・説明書

・資金・ロット表(エクセルファイル)(ロット表は説明書の中にもあります。こちらは法人口座、海外口座でやる人用となります。デフォルトは100倍)

・中級者戦略レポート

・長く運用するコツ

■要点まとめ

●表に基づいてご自身にあったロットを決めてEAを稼働

●EAは10コまでポジションを持ちます。

●10コで、採用したレート以上の下落がなければ強制ロスカットされない計算となります。

●日本の個人口座を想定しています。

●時期によりますが、利益はそんなではないので中級者用に利益アップ戦略レポート付き

●特に始める時期が、高値の場合(RSIの値が高い時)、フィルターにかかりエントリーしませんのでご了承ください。

●ロット表は50万円を想定して記載していますが、10万円からでも出来ます。(単純にロットを5で割ってください)

■注意点

・推奨業者以外でやる場合、証拠金を確認してください。

資金・ロット表は推奨口座での証拠金をもとに計算しています。

(時々、1万通貨は5000円で固定、みたいな業者があります)

・ご自身で計算があっているかを確認して、ロットを決めてください。

・業者の取り決めの変更などが今後あるかもしれません。それらの情報などご自身で判断して動けるようにお願します。

・できるだけ情報を出しますので、それを理解した上で、自己責任のもと運用するようにしてください。もちろん分からないことについてはできる限り、質問にお答えいたします。

まずこの簡単な理屈を理解されているでしょうか?

ランド円「11万円を10.0の時に1万通貨で買いエントリー」した場合、

9.00まで下がれば含み損-1万円。

5.00まで下がれば含み損-5万円。

0円まで下がれば含み損-10万円

0円まで下がったとしても、もうそれ以上含み損が大きくなりません!

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

つまり「11万円を10.0の時に1万通貨で買いエントリー」した場合、

損切りなしトレードは「可能」と言えるのではないでしょうか??

経験者にはわかり切ったことかも知れませんが、

資金管理さえ出来ればランド円は「損切りなしトレード」が可能なんです。

*もちろんそんな単純なEAではありません。

この理屈他の通貨でも当てはまりますが、ランド円はスワップがきっちり毎日つくというのと、10.00からならば「たったの-1000pips」までの範囲で考えればよいという利点があります。

ロット表を用意しましたので、どこでエントリーする時に、どれくらいのロットまでなら大丈夫か?というのが一目で分かります。

もちろん単純に、そのロットでその時エントリーして放置すればスワップは貯まりますが、高値でエントリーした場合かなり長い間含み損が解消されないままになり精神衛生上よくありません。

そのような「レバレッジ」や「エントリー」のことを総合的に考え、息の長いトレードをするEAとその戦略についてまとめました。

もう一度断っておきますが、これは長い目での運用を目指したものなので利益率はたいしたことありません。EAだけだと月利1%以下もあります。(利益率アップ戦略をものにすれば違いますがそれは裁量を要します)

しかし、きっと10年後もFX-ONが続いていればコツコツと利益を出しています。

なぜなら0円まで下落しても「強制ロスカット」されないロットだからです。

そしてこの実績、含み損も持っていますが、その含み損にはスワップが貯まっていっています。

■仕組み

■EAの概要

•RSIが低い時だけエントリー

•損切りなしの買いのみのエントリー

•ポジション制限10コまで

■資金・ロット表

あなたの投資する資金にあった、国内口座で想定した計算表を付けました。

含み損抱えても×円まで下落しても崩壊しない取引をすればいいのです。

(一応マニュアルでは「0円までの下落」「5円までの下落」、「7円までの下落」で数値を出しています。自己責任で選んでいただきロットを決定してください)

(7.76がリーマンショック後の最安値)

■中級者用、利益アップ戦略

仕組みや考えを完全に理解出来ている方は、ここへ進んでいただければと思います。

EAだけですと利益が少なすぎる、と必ず思うはずですので。

利益アップのための秘策は、「あるルールに基づいたピラミッディング」です。

10コのうちの1つのポジションはRSIが低い時に発動されます。

そのポジションを皮切りに、ルールに基づいたピラミッディングをすることで、

高値の時に利益が発生しないという事態を防ぎ、かつ年利を高くすることが目的です。

特別レポートを用意しましたので、それに基づいて自動売買に裁量を加えてやるということとなります。

開発者がやっている方法を載せますので、それを元にご自身の判断でできる方のみ実行してください。

■商品概要

・自分年金戦略EA

・FX-ON様のセキュリティファイル

・説明書

・資金・ロット表(エクセルファイル)(ロット表は説明書の中にもあります。こちらは法人口座、海外口座でやる人用となります。デフォルトは100倍)

・中級者戦略レポート

・長く運用するコツ

■要点まとめ

●表に基づいてご自身にあったロットを決めてEAを稼働

●EAは10コまでポジションを持ちます。

●10コで、採用したレート以上の下落がなければ強制ロスカットされない計算となります。

●日本の個人口座を想定しています。

●時期によりますが、利益はそんなではないので中級者用に利益アップ戦略レポート付き

●特に始める時期が、高値の場合(RSIの値が高い時)、フィルターにかかりエントリーしませんのでご了承ください。

●ロット表は50万円を想定して記載していますが、10万円からでも出来ます。(単純にロットを5で割ってください)

■注意点

・推奨業者以外でやる場合、証拠金を確認してください。

資金・ロット表は推奨口座での証拠金をもとに計算しています。

(時々、1万通貨は5000円で固定、みたいな業者があります)

・ご自身で計算があっているかを確認して、ロットを決めてください。

・業者の取り決めの変更などが今後あるかもしれません。それらの情報などご自身で判断して動けるようにお願します。

・できるだけ情報を出しますので、それを理解した上で、自己責任のもと運用するようにしてください。もちろん分からないことについてはできる限り、質問にお答えいたします。วันที่เริ่มขาย

:

30/08/2013 10:07

จำนวนผู้ใช้: 19คน

ราคา:¥23,000 (รวมภาษี)

เกี่ยวกับ One click order

●วิธีการชำระเงิน

Forward Test

Backtest

Forward Test

FOREX.com(JP)บัญชีเดโม่[ผลการเทรดที่แท้จริงอาจแตกต่างกันไปขึ้นอยู่กับแต่ละโบรกเกอร์]

Open Date | Symbol | Buy/Sell | Open Price | S/L | T/P | Close Date | Close Price | Lots | Commission | Taxes | Swap | Net Profit | Profit/Loss |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ไม่มีข้อมูล | |||||||||||||

วันที่เริ่มขาย : 30/08/2013 10:07

จำนวนผู้ใช้: 19คน

ราคา:¥23,000 (รวมภาษี)

เกี่ยวกับ One click order

●วิธีการชำระเงิน

เกี่ยวกับการซื้อขาย Forex แบบอัตโนมัติ

การซื้อขาย Forex แบบอัตโนมัติ (MT4 EA) คืออะไร

การซื้อขายอัตโนมัติในตลาดแลกเปลี่ยน (Forex) คือการซื้อขายโดยอัตโนมัติที่ถูกสร้างขึ้นโดยโปรแกรมมิ่งและรวมกฎการซื้อขายและกฎการปิดที่ล้วนตั้งไว้ล่วงหน้าไว้ด้วยกัน วิธีการที่ใช้ในการซื้อขายอัตโนมัติสามารถมีหลายวิธี แต่ใน GogoJungle เราใช้ Experts Advisors (EA) ที่ทำงานบนแพลตฟอร์มการซื้อขาย MT4 เพื่อการซื้อขายอัตโนมัติ

ประเภทการซื้อขายของการซื้อขาย Forex แบบอัตโนมัติ

มี EA ประเภทการซื้อขายหลายประเภทที่ใช้ใน MT4

เช่นเดียวกับการซื้อขายตามดุลยพินิจ มีวิธีการซื้อขายหลายประเภท เช่น วิธีการซื้อขายที่รวมตัวบ่งชี้เพื่อกำหนดเวลาของการซื้อขายและการชำระบัญชี การซื้อและขายซ้ำในช่วงเวลาราคาคงที่ (pips) และวิธีการซื้อขายที่ใช้ความผิดปกติของตลาดและ ลักษณะเวลา มีหลายประเภทตามวิธีการซื้อขายที่ใช้ดุลยพินิจ

การจำแนกประเภทอย่างง่ายคือ

・Scalping (ประเภทของธุรกรรมที่เสร็จสิ้นภายในไม่กี่นาทีถึงไม่กี่ชั่วโมง),

・การซื้อขายรายวัน (ประเภทของธุรกรรมที่เสร็จสิ้นภายในไม่กี่ชั่วโมงถึงหนึ่งวัน)

・สวิง (ประเภทการซื้อขายในระยะเวลาค่อนข้างนานตั้งแต่หนึ่งวันขึ้นไปถึงประมาณหนึ่งสัปดาห์)

・Nampin Martin (ประเภทที่ถือครองหลายตำแหน่งในช่วงเวลาที่เท่ากันหรือไม่เท่ากัน และชำระทั้งหมดพร้อมกันเมื่อมีการทำกำไร ประเภทที่เพิ่มจำนวนล็อตในแต่ละขั้นเรียกว่า martingale)

・Anomaly EA (Mid-price trading, early morning scalping) และอื่น ๆ

เช่นเดียวกับการซื้อขายตามดุลยพินิจ มีวิธีการซื้อขายหลายประเภท เช่น วิธีการซื้อขายที่รวมตัวบ่งชี้เพื่อกำหนดเวลาของการซื้อขายและการชำระบัญชี การซื้อและขายซ้ำในช่วงเวลาราคาคงที่ (pips) และวิธีการซื้อขายที่ใช้ความผิดปกติของตลาดและ ลักษณะเวลา มีหลายประเภทตามวิธีการซื้อขายที่ใช้ดุลยพินิจ

การจำแนกประเภทอย่างง่ายคือ

・Scalping (ประเภทของธุรกรรมที่เสร็จสิ้นภายในไม่กี่นาทีถึงไม่กี่ชั่วโมง),

・การซื้อขายรายวัน (ประเภทของธุรกรรมที่เสร็จสิ้นภายในไม่กี่ชั่วโมงถึงหนึ่งวัน)

・สวิง (ประเภทการซื้อขายในระยะเวลาค่อนข้างนานตั้งแต่หนึ่งวันขึ้นไปถึงประมาณหนึ่งสัปดาห์)

・Nampin Martin (ประเภทที่ถือครองหลายตำแหน่งในช่วงเวลาที่เท่ากันหรือไม่เท่ากัน และชำระทั้งหมดพร้อมกันเมื่อมีการทำกำไร ประเภทที่เพิ่มจำนวนล็อตในแต่ละขั้นเรียกว่า martingale)

・Anomaly EA (Mid-price trading, early morning scalping) และอื่น ๆ

ความเสี่ยง ข้อดี และข้อเสียของการซื้อขาย Forex แบบอัตโนมัติ

เมื่อมีส่วนร่วมใน Forex การซื้อขายอัตโนมัติก็มีความเสี่ยงเช่นเดียวกับการซื้อขายที่ใช้ดุลยพินิจ

อย่างไรก็ตาม ข้อได้เปรียบที่สำคัญของการซื้อขายอัตโนมัติคือความสามารถในการจำกัดและคาดการณ์ความเสี่ยงล่วงหน้า

[ความเสี่ยง]

พื้นฐานของการซื้อขายฟอเร็กซ์คือความเสี่ยงในการซื้อขายที่มีอยู่ในการซื้อขายอัตโนมัติเช่นกัน

・ความเสี่ยงขนาดล็อต

การเพิ่มขนาดล็อตโดยการบังคับเนื่องจากอัตราการชนะที่สูง ในบางกรณีที่เกิดขึ้นได้ยาก ขึ้นอยู่กับ EA อาจทำให้สูญเสีย Pips อย่างมากเมื่อเกิดการขาดทุน การตรวจสอบ SL Pips และจำนวนตำแหน่งที่ถืออยู่เป็นสิ่งสำคัญก่อนที่จะดำเนินการกับล็อตที่เหมาะสม

・ความเสี่ยงจากความผันผวนของตลาดอย่างรวดเร็ว

มีกรณีที่ราคาตลาดผันผวนอย่างรวดเร็วเนื่องจากการประกาศดัชนีหรือข่าวที่ไม่คาดฝัน การซื้อขายของระบบไม่ได้คำนึงถึงความเคลื่อนไหวของตลาดที่ไม่สามารถคาดเดาได้ ทำให้ไม่สามารถตัดสินใจได้ว่าจะชำระล่วงหน้าหรือละเว้นจากการซื้อขาย เพื่อเป็นมาตรการตอบโต้ การใช้เครื่องมือที่จะหยุด EA ตามการประกาศตัวบ่งชี้หรือ VIX (ดัชนีความกลัว) ก็เป็นไปได้เช่นกัน

[คุณประโยชน์]

・ให้บริการตลอด 24 ชั่วโมง

หากมีโอกาส ระบบการซื้อขายจะดำเนินการซื้อขายในนามของคุณอย่างสม่ำเสมอ มันพิสูจน์ได้ว่าเป็นเครื่องมือที่สะดวกอย่างยิ่งสำหรับผู้ที่ไม่สามารถจัดสรรเวลาในการซื้อขายได้

・ซื้อขายอย่างไม่เต็มใจโดยไม่ถูกครอบงำด้วยอารมณ์

ไม่มีการปรับเปลี่ยนกฎการให้บริการด้วยตนเอง ซึ่งเป็นแนวโน้มทั่วไปของมนุษย์ เช่น การเพิ่มขนาดล็อตหลังจากการขาดทุนติดต่อกันในการซื้อขายตามดุลยพินิจ หรือในทางกลับกัน การได้รับผลกำไรอย่างเร่งรีบโดยได้รับผลกำไรน้อยที่สุด

・สามารถเข้าถึงได้สำหรับผู้เริ่มต้น

หากต้องการมีส่วนร่วมในการซื้อขายฟอเร็กซ์ ไม่มีข้อกำหนดเบื้องต้นในการศึกษา ใครก็ตามที่ใช้ระบบการซื้อขายจะได้รับผลลัพธ์เดียวกัน

[ข้อเสีย]

・ไม่สามารถเพิ่มความถี่ในการซื้อขายได้ตามต้องการ

เนื่องจากระบบการซื้อขายดำเนินการตามเงื่อนไขที่ตั้งโปรแกรมไว้ล่วงหน้า ขึ้นอยู่กับประเภทของ EA ระบบจึงอาจดำเนินการซื้อขายเพียงไม่กี่ครั้งต่อเดือน

・ความเหมาะสมอาจแตกต่างกันไปตามสภาวะตลาด

ขึ้นอยู่กับประเภทการซื้อขายของ EA มีช่วงเวลาที่เหมาะสมกับการซื้อขายตามแนวโน้มมากกว่าและช่วงเวลาที่เหมาะกับการซื้อขายที่ขัดแย้งกันมากกว่า ทำให้ผลลัพธ์ที่สม่ำเสมอในทุกช่วงเวลาไม่น่าเป็นไปได้ แม้ว่าปีที่แล้วอาจมีผลลัพธ์ที่ดี แต่ผลการดำเนินงานในปีนี้อาจไม่มีแนวโน้มที่ดีนัก ซึ่งจำเป็นต้องใช้ดุลยพินิจในระดับหนึ่งในการพิจารณาว่าเป็นเวลาที่เหมาะสมในการดำเนินการหรือไม่

อย่างไรก็ตาม ข้อได้เปรียบที่สำคัญของการซื้อขายอัตโนมัติคือความสามารถในการจำกัดและคาดการณ์ความเสี่ยงล่วงหน้า

[ความเสี่ยง]

พื้นฐานของการซื้อขายฟอเร็กซ์คือความเสี่ยงในการซื้อขายที่มีอยู่ในการซื้อขายอัตโนมัติเช่นกัน

・ความเสี่ยงขนาดล็อต

การเพิ่มขนาดล็อตโดยการบังคับเนื่องจากอัตราการชนะที่สูง ในบางกรณีที่เกิดขึ้นได้ยาก ขึ้นอยู่กับ EA อาจทำให้สูญเสีย Pips อย่างมากเมื่อเกิดการขาดทุน การตรวจสอบ SL Pips และจำนวนตำแหน่งที่ถืออยู่เป็นสิ่งสำคัญก่อนที่จะดำเนินการกับล็อตที่เหมาะสม

・ความเสี่ยงจากความผันผวนของตลาดอย่างรวดเร็ว

มีกรณีที่ราคาตลาดผันผวนอย่างรวดเร็วเนื่องจากการประกาศดัชนีหรือข่าวที่ไม่คาดฝัน การซื้อขายของระบบไม่ได้คำนึงถึงความเคลื่อนไหวของตลาดที่ไม่สามารถคาดเดาได้ ทำให้ไม่สามารถตัดสินใจได้ว่าจะชำระล่วงหน้าหรือละเว้นจากการซื้อขาย เพื่อเป็นมาตรการตอบโต้ การใช้เครื่องมือที่จะหยุด EA ตามการประกาศตัวบ่งชี้หรือ VIX (ดัชนีความกลัว) ก็เป็นไปได้เช่นกัน

[คุณประโยชน์]

・ให้บริการตลอด 24 ชั่วโมง

หากมีโอกาส ระบบการซื้อขายจะดำเนินการซื้อขายในนามของคุณอย่างสม่ำเสมอ มันพิสูจน์ได้ว่าเป็นเครื่องมือที่สะดวกอย่างยิ่งสำหรับผู้ที่ไม่สามารถจัดสรรเวลาในการซื้อขายได้

・ซื้อขายอย่างไม่เต็มใจโดยไม่ถูกครอบงำด้วยอารมณ์

ไม่มีการปรับเปลี่ยนกฎการให้บริการด้วยตนเอง ซึ่งเป็นแนวโน้มทั่วไปของมนุษย์ เช่น การเพิ่มขนาดล็อตหลังจากการขาดทุนติดต่อกันในการซื้อขายตามดุลยพินิจ หรือในทางกลับกัน การได้รับผลกำไรอย่างเร่งรีบโดยได้รับผลกำไรน้อยที่สุด

・สามารถเข้าถึงได้สำหรับผู้เริ่มต้น

หากต้องการมีส่วนร่วมในการซื้อขายฟอเร็กซ์ ไม่มีข้อกำหนดเบื้องต้นในการศึกษา ใครก็ตามที่ใช้ระบบการซื้อขายจะได้รับผลลัพธ์เดียวกัน

[ข้อเสีย]

・ไม่สามารถเพิ่มความถี่ในการซื้อขายได้ตามต้องการ

เนื่องจากระบบการซื้อขายดำเนินการตามเงื่อนไขที่ตั้งโปรแกรมไว้ล่วงหน้า ขึ้นอยู่กับประเภทของ EA ระบบจึงอาจดำเนินการซื้อขายเพียงไม่กี่ครั้งต่อเดือน

・ความเหมาะสมอาจแตกต่างกันไปตามสภาวะตลาด

ขึ้นอยู่กับประเภทการซื้อขายของ EA มีช่วงเวลาที่เหมาะสมกับการซื้อขายตามแนวโน้มมากกว่าและช่วงเวลาที่เหมาะกับการซื้อขายที่ขัดแย้งกันมากกว่า ทำให้ผลลัพธ์ที่สม่ำเสมอในทุกช่วงเวลาไม่น่าเป็นไปได้ แม้ว่าปีที่แล้วอาจมีผลลัพธ์ที่ดี แต่ผลการดำเนินงานในปีนี้อาจไม่มีแนวโน้มที่ดีนัก ซึ่งจำเป็นต้องใช้ดุลยพินิจในระดับหนึ่งในการพิจารณาว่าเป็นเวลาที่เหมาะสมในการดำเนินการหรือไม่

อุปกรณ์และสภาพแวดล้อมที่จำเป็นสำหรับการดำเนินการซื้อขายแบบอัตโนมัติ

สิ่งที่จำเป็นในการดำเนินการซื้อขายอัตโนมัติ (EA) บน MT4 คือดังนี้:

・MT4 (MetaTrader 4 จำเป็นต้องเปิดบัญชีกับบริษัท Forex ที่ให้บริการ MT4)

・EA (โปรแกรมสำหรับการซื้อขายอัตโนมัติ)

・เงินฝากปฏิบัติการที่จำเป็นสำหรับการใช้งาน EA

・พีซีที่สามารถทำงานได้ตลอด 24 ชั่วโมงหรือ VPS (Virtual Private Server) โดยที่พีซีเสมือนโฮสต์บนเซิร์ฟเวอร์คลาวด์เพื่อรัน MT4

・MT4 (MetaTrader 4 จำเป็นต้องเปิดบัญชีกับบริษัท Forex ที่ให้บริการ MT4)

・EA (โปรแกรมสำหรับการซื้อขายอัตโนมัติ)

・เงินฝากปฏิบัติการที่จำเป็นสำหรับการใช้งาน EA

・พีซีที่สามารถทำงานได้ตลอด 24 ชั่วโมงหรือ VPS (Virtual Private Server) โดยที่พีซีเสมือนโฮสต์บนเซิร์ฟเวอร์คลาวด์เพื่อรัน MT4

การติดตั้ง MT4 และการเข้าสู่ระบบบัญชี

หากคุณเปิดบัญชีกับโบรกเกอร์ ที่รองรับ MT4 คุณจะสามารถใช้ MT4 ได้

MT4 เป็นซอฟต์แวร์ประเภทสแตนด์อโลนที่ติดตั้งและใช้งานบนคอมพิวเตอร์ของคุณ ดังนั้นให้ดาวน์โหลดไฟล์โปรแกรมจากเว็บไซต์ของโบรกเกอร์ที่คุณเปิดบัญชีและติดตั้งลงในคอมพิวเตอร์ของคุณ

นอกจากนี้ยังมีบัญชีทดลองและบัญชีจริง และเมื่อสมัครบัญชีทดลอง คุณจะได้สัมผัสกับการซื้อขายด้วยเงินเสมือนจริง หลังจากเปิดบัญชีจริงแล้ว ให้เลือกเซิร์ฟเวอร์การเชื่อมต่อที่กำหนดโดยโบรกเกอร์ ป้อนรหัสผ่านและเข้าสู่ระบบบัญชี

เมื่อคุณฝากเงินเข้าบัญชีของคุณโดยใช้วิธีการที่โบรกเกอร์กำหนด เงินจะปรากฏในบัญชี MT4 ของคุณและคุณจะสามารถซื้อขายได้

นอกจากนี้ยังมีบัญชีทดลองและบัญชีจริง และเมื่อสมัครบัญชีทดลอง คุณจะได้สัมผัสกับการซื้อขายด้วยเงินเสมือนจริง หลังจากเปิดบัญชีจริงแล้ว ให้เลือกเซิร์ฟเวอร์การเชื่อมต่อที่กำหนดโดยโบรกเกอร์ ป้อนรหัสผ่านและเข้าสู่ระบบบัญชี

เมื่อคุณฝากเงินเข้าบัญชีของคุณโดยใช้วิธีการที่โบรกเกอร์กำหนด เงินจะปรากฏในบัญชี MT4 ของคุณและคุณจะสามารถซื้อขายได้

วิธีการติดตั้ง EA บน MT4

หากต้องการตั้งค่า EA เมื่อคุณซื้อผ่าน GogoJungle ให้ทำตามขั้นตอนด้านล่าง:

ขั้นแรก ดาวน์โหลดไฟล์ EA ที่ซื้อจากหน้าของฉันบน GogoJungle คุณจะดาวน์โหลดไฟล์ zip (บีบอัด) ดังนั้นให้คลิกขวาเพื่อแตกไฟล์และดึงไฟล์ชื่อ '◯◯◯ (ชื่อ EA)_A19GAw09 (ตัวอักษรและตัวเลข 8 ตัวใดก็ได้ ).ex4' จากด้านใน

จากนั้น เปิด MT4 และไปที่ 'File' → 'Open Data Folder' → 'MQL4' → โฟลเดอร์ 'Experts' และวางไฟล์ ex4 ไว้ข้างใน เมื่อเสร็จแล้ว ปิด MT4 และรีสตาร์ท จากนั้น ไปที่เมนูด้านบน ' เครื่องมือ' → 'ตัวเลือก' และภายใต้ 'ที่ปรึกษาผู้เชี่ยวชาญ' ตรวจสอบให้แน่ใจว่าได้เลือก 'อนุญาตการซื้อขายอัตโนมัติ' และ 'อนุญาตการนำเข้า DLL' แล้ว จากนั้นกด ตกลง เพื่อปิด

คู่สกุลเงินและกรอบเวลาที่จำเป็นสำหรับการดำเนินการที่ถูกต้องของ EA ระบุไว้ในหน้าการขายของ EA อ้างอิงข้อมูลนี้และเปิดแผนภูมิของกรอบเวลาคู่สกุลเงินที่ถูกต้อง (เช่น USDJPY5M สำหรับแผนภูมิ 5 นาที USDJPY).

ภายในแถบนำทางเมนู ใต้ 'Expert Advisors' คุณจะพบชื่อไฟล์ EA ที่คุณวางไว้ก่อนหน้านี้ คลิกเพื่อเลือก จากนั้นลากและวางลงในแผนภูมิโดยตรงเพื่อโหลด EA หรือคุณสามารถดับเบิลคลิกที่ EA ชื่อเพื่อโหลดลงในแผนภูมิที่เลือก

หาก 'Authentication Success' ปรากฏขึ้นที่ด้านซ้ายบนของแผนภูมิ แสดงว่าการรับรองความถูกต้องสำเร็จแล้ว ในการใช้งาน EA คุณต้องให้พีซีของคุณทำงานตลอด 24 ชั่วโมง ดังนั้น ให้ปิดการใช้งานฟังก์ชันสลีปอัตโนมัติหรือโฮสต์ MT4 บน VPS และใช้งาน EA

ขั้นแรก ดาวน์โหลดไฟล์ EA ที่ซื้อจากหน้าของฉันบน GogoJungle คุณจะดาวน์โหลดไฟล์ zip (บีบอัด) ดังนั้นให้คลิกขวาเพื่อแตกไฟล์และดึงไฟล์ชื่อ '◯◯◯ (ชื่อ EA)_A19GAw09 (ตัวอักษรและตัวเลข 8 ตัวใดก็ได้ ).ex4' จากด้านใน

จากนั้น เปิด MT4 และไปที่ 'File' → 'Open Data Folder' → 'MQL4' → โฟลเดอร์ 'Experts' และวางไฟล์ ex4 ไว้ข้างใน เมื่อเสร็จแล้ว ปิด MT4 และรีสตาร์ท จากนั้น ไปที่เมนูด้านบน ' เครื่องมือ' → 'ตัวเลือก' และภายใต้ 'ที่ปรึกษาผู้เชี่ยวชาญ' ตรวจสอบให้แน่ใจว่าได้เลือก 'อนุญาตการซื้อขายอัตโนมัติ' และ 'อนุญาตการนำเข้า DLL' แล้ว จากนั้นกด ตกลง เพื่อปิด

คู่สกุลเงินและกรอบเวลาที่จำเป็นสำหรับการดำเนินการที่ถูกต้องของ EA ระบุไว้ในหน้าการขายของ EA อ้างอิงข้อมูลนี้และเปิดแผนภูมิของกรอบเวลาคู่สกุลเงินที่ถูกต้อง (เช่น USDJPY5M สำหรับแผนภูมิ 5 นาที USDJPY).

ภายในแถบนำทางเมนู ใต้ 'Expert Advisors' คุณจะพบชื่อไฟล์ EA ที่คุณวางไว้ก่อนหน้านี้ คลิกเพื่อเลือก จากนั้นลากและวางลงในแผนภูมิโดยตรงเพื่อโหลด EA หรือคุณสามารถดับเบิลคลิกที่ EA ชื่อเพื่อโหลดลงในแผนภูมิที่เลือก

หาก 'Authentication Success' ปรากฏขึ้นที่ด้านซ้ายบนของแผนภูมิ แสดงว่าการรับรองความถูกต้องสำเร็จแล้ว ในการใช้งาน EA คุณต้องให้พีซีของคุณทำงานตลอด 24 ชั่วโมง ดังนั้น ให้ปิดการใช้งานฟังก์ชันสลีปอัตโนมัติหรือโฮสต์ MT4 บน VPS และใช้งาน EA

กรณีที่ต้องการเปลี่ยนบัญชีที่ใช้งาน

EA จาก GogoJungle สามารถใช้กับบัญชีจริงหนึ่งบัญชีและบัญชีทดลองหนึ่งบัญชีต่อ EA

หากคุณต้องการใช้กับบัญชีอื่นที่ไม่ใช่บัญชีที่ผ่านการรับรองความถูกต้อง คุณจะต้องรีเซ็ตบัญชีที่ลงทะเบียน

หากต้องการรีเซ็ตบัญชี ให้ปิด MT4 ที่มีการลงทะเบียนการรับรองความถูกต้องของเว็บ จากนั้นไปที่หน้าของฉันบน GogoJungle > การใช้งาน > เนื้อหาดิจิทัล > EA ที่เกี่ยวข้อง > กดปุ่ม 'รีเซ็ต' เพื่อดูหมายเลขการลงทะเบียน และบัญชีที่ลงทะเบียนจะถูกปล่อย .

เมื่อบัญชีอยู่ในสถานะรีเซ็ต การใช้ EA กับบัญชี MT4 อื่นจะเป็นการลงทะเบียนบัญชีใหม่

นอกจากนี้คุณยังสามารถรีเซ็ตบัญชีได้ไม่จำกัดจำนวนครั้ง

หากคุณต้องการใช้กับบัญชีอื่นที่ไม่ใช่บัญชีที่ผ่านการรับรองความถูกต้อง คุณจะต้องรีเซ็ตบัญชีที่ลงทะเบียน

หากต้องการรีเซ็ตบัญชี ให้ปิด MT4 ที่มีการลงทะเบียนการรับรองความถูกต้องของเว็บ จากนั้นไปที่หน้าของฉันบน GogoJungle > การใช้งาน > เนื้อหาดิจิทัล > EA ที่เกี่ยวข้อง > กดปุ่ม 'รีเซ็ต' เพื่อดูหมายเลขการลงทะเบียน และบัญชีที่ลงทะเบียนจะถูกปล่อย .

เมื่อบัญชีอยู่ในสถานะรีเซ็ต การใช้ EA กับบัญชี MT4 อื่นจะเป็นการลงทะเบียนบัญชีใหม่

นอกจากนี้คุณยังสามารถรีเซ็ตบัญชีได้ไม่จำกัดจำนวนครั้ง

วิธีการจัดการเมื่อมีปัญหา

หากคุณพบข้อผิดพลาดกับการรับรองความถูกต้องของเว็บ หรือหาก EA กำลังซื้อขายบนหน้าประสิทธิภาพล่วงหน้าของ GogoJungle แต่ไม่ใช่ในบัญชีของคุณเอง อาจเกิดจากสาเหตุหลายประการ สำหรับรายละเอียดเพิ่มเติม โปรดดูที่ลิงก์ต่อไปนี้:

→ รายการที่ต้องตรวจสอบเมื่อ EA ไม่ทำงาน

→ รายการที่ต้องตรวจสอบเมื่อ EA ไม่ทำงาน

เกี่ยวกับขนาดของล็อตการซื้อขาย

โดยปกติขนาดล็อตในการซื้อขาย Forex คือ

1 ล็อต = 100,000 สกุลเงิน

0.1 ล็อต = 10,000 สกุลเงิน

0.01 ล็อต = 1,000 สกุลเงิน

มันกลายเป็น.

ในสกุลเงินดอลลาร์เยน 1 ล็อต = 100,000 ดอลลาร์

มาร์จิ้นที่จำเป็นสำหรับการถือครองล็อตนั้นถูกกำหนดโดยเลเวอเรจที่กำหนดโดยบริษัท FX

หากเลเวอเรจเป็น 25 เท่า หลักประกันที่ต้องถือ 10,000 USD/JPY จะเท่ากับ 10,000*109 (*ในอัตรา 109 เยนต่อดอลลาร์) ÷ 25 = 43,600 เยน

1 ล็อต = 100,000 สกุลเงิน

0.1 ล็อต = 10,000 สกุลเงิน

0.01 ล็อต = 1,000 สกุลเงิน

มันกลายเป็น.

ในสกุลเงินดอลลาร์เยน 1 ล็อต = 100,000 ดอลลาร์

มาร์จิ้นที่จำเป็นสำหรับการถือครองล็อตนั้นถูกกำหนดโดยเลเวอเรจที่กำหนดโดยบริษัท FX

หากเลเวอเรจเป็น 25 เท่า หลักประกันที่ต้องถือ 10,000 USD/JPY จะเท่ากับ 10,000*109 (*ในอัตรา 109 เยนต่อดอลลาร์) ÷ 25 = 43,600 เยน

คำศัพท์เกี่ยวกับการซื้อขายแบบอัตโนมัติ

・ปัจจัยกำไร: กำไรทั้งหมด − ขาดทุนทั้งหมด

・อัตราผลตอบแทนความเสี่ยง: กำไรและขาดทุนทั้งหมดในระหว่างงวด ÷ การเบิกเงินสูงสุด

・การเบิกถอนสูงสุด: การสูญเสียที่ยังไม่เกิดขึ้นสูงสุดในระหว่างระยะเวลาดำเนินการ

・จำนวนตำแหน่งสูงสุด: จำนวนตำแหน่งสูงสุดที่ EA สามารถถือได้ในทางทฤษฎีในเวลาเดียวกัน

・TP (Take Profit): กำไร Pips (หรือจำนวนที่ระบุ ฯลฯ) ในการตั้งค่า EA

・SL (Stop Loss): จุดขาดทุนสูงสุด (หรือจำนวนที่ระบุ ฯลฯ) ในการตั้งค่า EA

・Trailing stop: นี่คือวิธีการชำระเงินที่เพิ่มผลกำไรสูงสุดโดยการเพิ่ม SL การชำระเงินในช่วงเวลาปกติ (ในทิศทางของผลกำไร) เมื่อมีการทำกำไรจำนวนหนึ่ง แทนที่จะชำระเงินตาม pip ที่ระบุ

・อัตราส่วนผลตอบแทนความเสี่ยง (อัตราส่วนผลตอบแทน): กำไรเฉลี่ย − ขาดทุนเฉลี่ย

・ทั้งสองตำแหน่ง: ถือทั้งตำแหน่งซื้อและขายในเวลาเดียวกัน (โบรกเกอร์บางแห่งไม่อนุญาตให้ใช้ทั้งสองตำแหน่ง)

・อัตราผลตอบแทนความเสี่ยง: กำไรและขาดทุนทั้งหมดในระหว่างงวด ÷ การเบิกเงินสูงสุด

・การเบิกถอนสูงสุด: การสูญเสียที่ยังไม่เกิดขึ้นสูงสุดในระหว่างระยะเวลาดำเนินการ

・จำนวนตำแหน่งสูงสุด: จำนวนตำแหน่งสูงสุดที่ EA สามารถถือได้ในทางทฤษฎีในเวลาเดียวกัน

・TP (Take Profit): กำไร Pips (หรือจำนวนที่ระบุ ฯลฯ) ในการตั้งค่า EA

・SL (Stop Loss): จุดขาดทุนสูงสุด (หรือจำนวนที่ระบุ ฯลฯ) ในการตั้งค่า EA

・Trailing stop: นี่คือวิธีการชำระเงินที่เพิ่มผลกำไรสูงสุดโดยการเพิ่ม SL การชำระเงินในช่วงเวลาปกติ (ในทิศทางของผลกำไร) เมื่อมีการทำกำไรจำนวนหนึ่ง แทนที่จะชำระเงินตาม pip ที่ระบุ

・อัตราส่วนผลตอบแทนความเสี่ยง (อัตราส่วนผลตอบแทน): กำไรเฉลี่ย − ขาดทุนเฉลี่ย

・ทั้งสองตำแหน่ง: ถือทั้งตำแหน่งซื้อและขายในเวลาเดียวกัน (โบรกเกอร์บางแห่งไม่อนุญาตให้ใช้ทั้งสองตำแหน่ง)

หน้าที่เกี่ยวข้องที่มีประโยชน์

・คู่มือการติดตั้ง MT4 EA (Expert Advisor) และ Indicator

・MT4 Beginner's Guide

・การตรวจสอบผลงานการซื้อขายระบบ (Forward & Back Testing)

・การเลือก EA ครั้งแรก! วิธีคำนวณเงินทุนที่แนะนำ

・เปรียบเทียบบัญชี MT4 ด้วย Spread, Swap, และความสามารถในการจัดการคำสั่งซื้อขาย

・Web Authentication คืออะไร?

・ตรวจสอบข้อสรุปเมื่อ EA ไม่ทำงาน

・MT4 Beginner's Guide

・การตรวจสอบผลงานการซื้อขายระบบ (Forward & Back Testing)

・การเลือก EA ครั้งแรก! วิธีคำนวณเงินทุนที่แนะนำ

・เปรียบเทียบบัญชี MT4 ด้วย Spread, Swap, และความสามารถในการจัดการคำสั่งซื้อขาย

・Web Authentication คืออะไร?

・ตรวจสอบข้อสรุปเมื่อ EA ไม่ทำงาน