オセアニアリピート

Comments(26)

- Whole period

- 2 years

- 1 year

- 6 months

- 3 months

- 1 month

Profit

:

485,168JPYProfit Factor

:

14.09Rate of return risk

?

:

1.4Average Profit

:

1,058JPYAverage Loss

:

-1,531JPYBalance

?

:

1,485,168JPYRate of return (all periods)?

:

37.42%Win Rate

:

95.32%

(489/513)

Maximum Position

?

:

15Maximum Drawdown

?

:

19.45%

(346,612JPY)

Maximum Profit

:

8,207JPYMaximum Loss

:

-5,471JPYRecommended Margin

?

:

1,296,710JPYUnrealized P/L

:

-346,612JPYDeposit

?

:

1,000,000JPYCurrency

:

JPY- Account

Operable Brokers

Usable with MT4-adopting brokers.

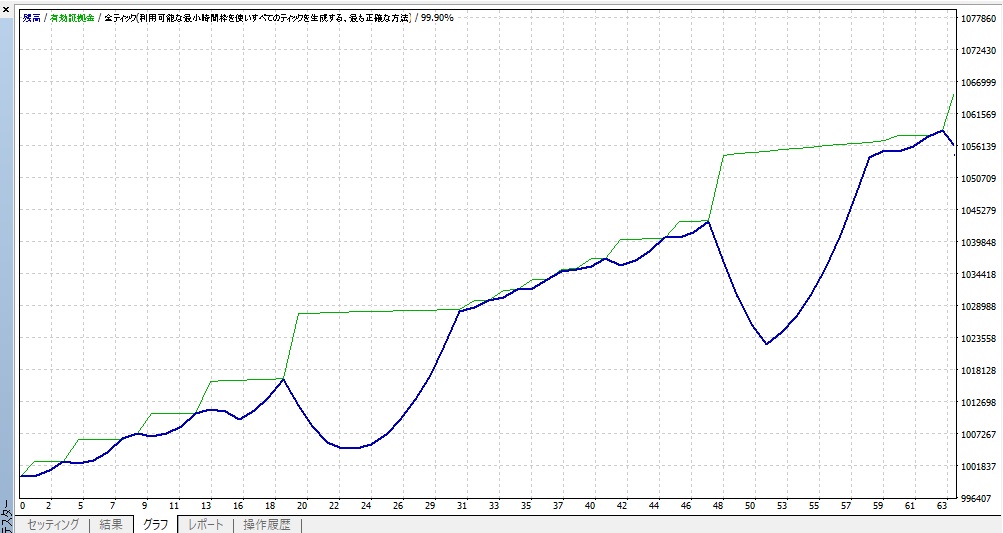

Real Performance (Pips)

※Displays results including swaps and fees

Forward testing (Profit)

Product Statistics

Product Comments

Monthly Statistics

2024

2023

2022

2021

2020

- Jan

- Feb

- Mar

- Apr

- May

- Jun

- Jul

- Aug

- Sep

- Oct

- Nov

- Dec

Calendar for Months

About EA's Strategy

Translating...

Currency Pairs

[AUD/NZD]

Trading Style

[Swing Trading]

[Position Trading]

Maximum Number Position

15

Maximum Lot

99

Chart Time Frame

M5

Maximum Stop Loss

0

Take Profit

10

Straddle Trading

Yes

Application Type

Metatrader Auto Trading

Other File Usages

No

設定項目

・売りポジ・買いポジともに、設定した上下限範囲内でリピートロジックでエントリーと決済を繰り返すEA。

・保有するポジション数をユーザー設定可能にしており、保有期間が長くなる場合もドローダウンを限定できます。※保有ポジションが最大ポジションになった場合に、エントリー発注をすべて取り消しますが、最大ポジションを持つタイミングで価格急変が起こった場合には最大ポジション以上にポジションを持つ場合があります。

・ポジション保有期間が長くなる場合に、Swapと手数料を考慮して「利益幅[pips]」で指定した利益を確保できるようにする「Swap込みで利益幅判定」機能を搭載。trueにすると、Swapと手数料を考慮して決済指値を決定します。この機能はナンピン決済、個別決済ともに対応。※Swapがプラスのときはfalseの方が利益増えます。

・5分足終了時に、各種設定内容の変更や保有ポジション数の変更をチェックして、必要な指値注文の変更などを実行。これによりポジション保有中の設定変更、保有ポジションの手動決済に対応。

・スプレッドが広がる6時台(夏時間)、7時台(冬時間)に取引を中断する機能を搭載。この時間帯に入る前に保留中の注文を削除し、新たな注文は発注しません。時刻判定はサーバー時刻ではなくEAが動作しているPCの時刻で行います。

・[売りポジ下限]から[売買ポジ間隔](デフォルト10pips)ごとに売りあがりエントリーを行い、[買いポジ上限]から買い下がりエントリーを行います。

・ポジションを持つ間隔をポジション数に応じて変動する機能を搭載(デフォルトで機能します)。ポジションが5を超えるごとに、ユーザー設定のポジ間隔(デフォルト10pips)を2倍、3倍・・と広く取ります。

・[売りポジ下限]と[買いポジ上限]の間ではエントリーを行いません。

・[売りポジ下限][買いポジ上限][売買ポジ間隔]を変更することで、エントリー頻度をユーザーが調整できます。

【設定項目の補足】

[ナンピンで決済]

[ナンピンで決済]を[true]にすると、保有ポジション全体の平均オープン価格を基準に[利益幅]を確保する水準で決済します。

[ナンピンで決済]を[true]にすると、保有ポジション全体の平均オープン価格を基準に[利益幅]を確保する水準で決済します。

[false]にすると各ポジションを[利益幅](デフォルト10pips)で決済します。[variable]にすると、ポジション数が[ナンピン決済の上限ポジション数]で指定した数以下の場合は[true]、ポジション数がこれを超えてくると[false]に切り替えます。

通常の決済と、ナンピンで決済の違いは、下図を参考にしてください。

ポジ間隔の変動機能とナンピン決済機能を有効にすることで、レンジが大きく変動した場合にも、含み損を限定して取引を継続できるようにしています。

○通常の決済の場合

○ナンピンで決済の場合

[上下限超えでヘッジ]

売りの上限、買いの下限を超えた場合は、保有ポジションの合計ロット数で反対ポジションを持って、含み損を限定させる機能。[true]でヘッジ機能が働く。

デフォルトの上下限は、下図の通り2014年以降のチャートを参考に設定。

[逆指値のみでエントリー]

通常のエントリーは、現在値からの上下で指値、逆指値エントリーを繰り返しますが、[逆指値のみでエントリー]を[true]にすると、逆指値エントリーのみに制限します。エントリー数は減る一方でドローダウンは低くなる傾向があります。

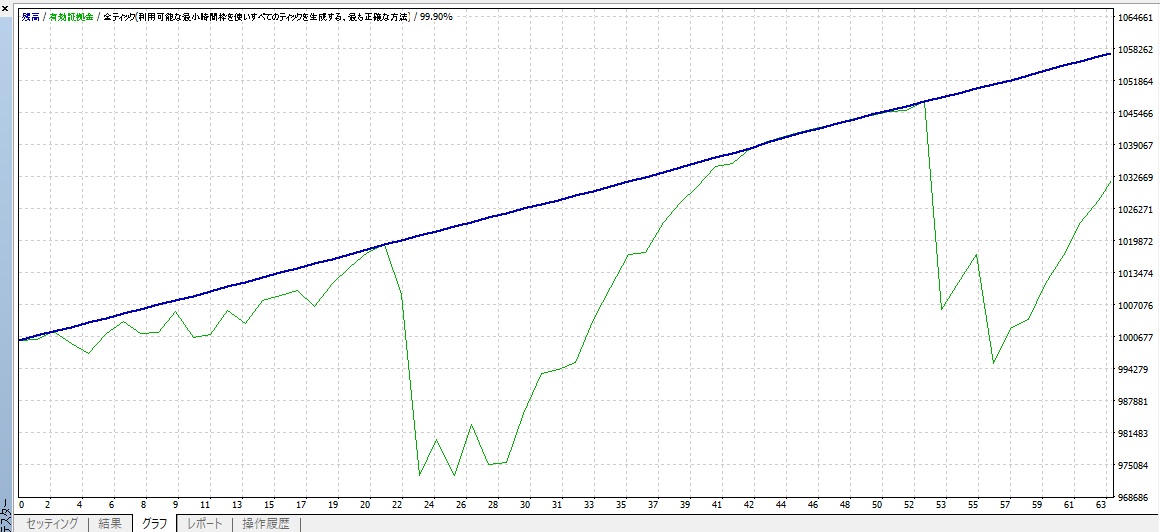

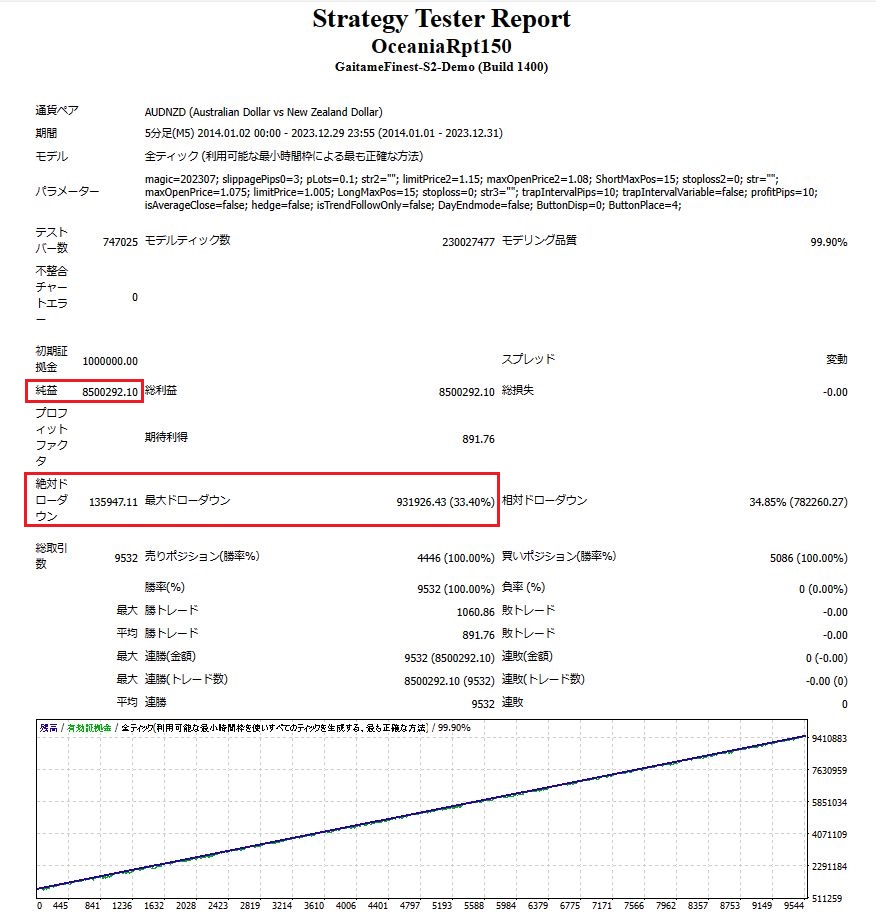

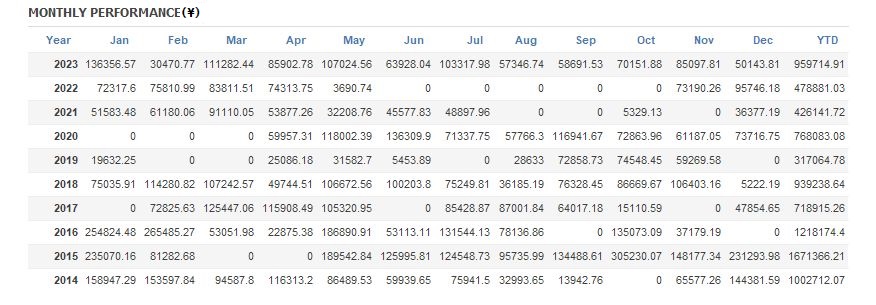

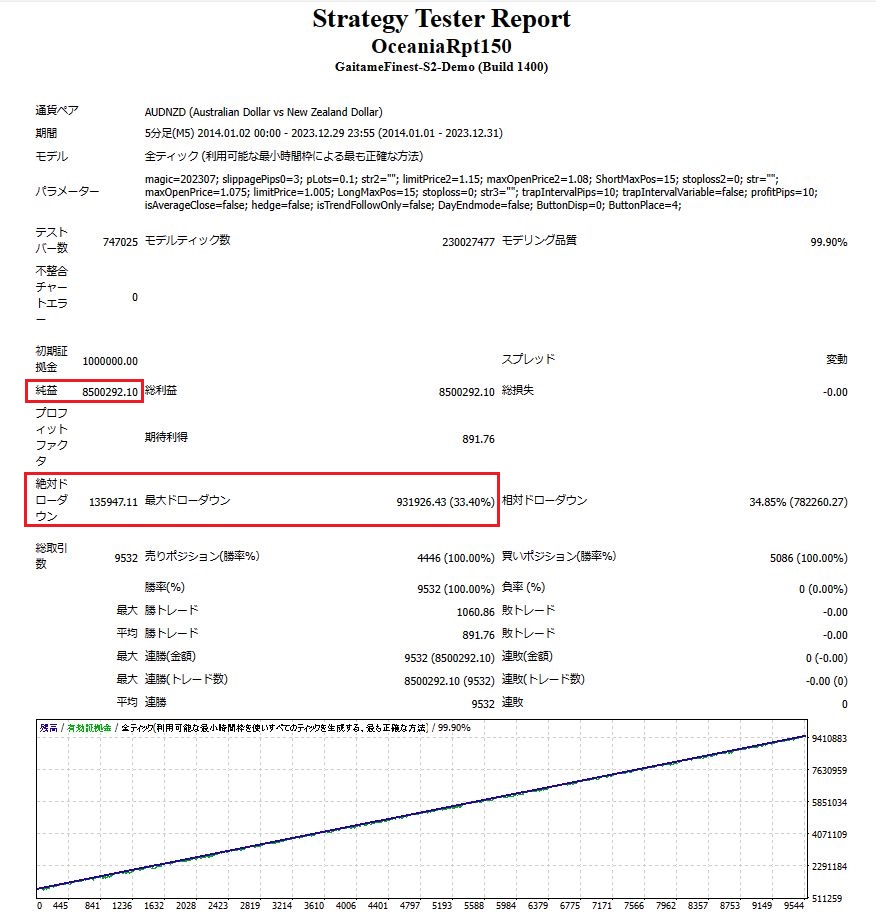

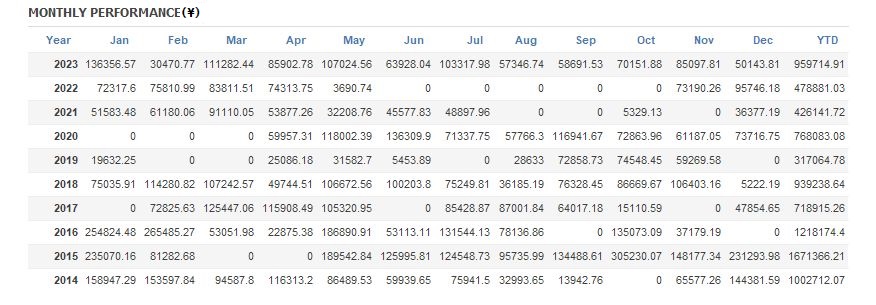

バックテスト結果

TDSで2014年1月1日~2023年12月29日までテストしました。

①最大ポジション数=15 ナンピン決済 エントリー幅変動(デフォルト設定の条件)

純益 678万5885円

②最大ポジション数=15 通常決済 エントリー幅変動

純益 757万3652円

③最大ポジション数=15 通常決済 エントリー幅固定

純益 850万0292円

¥1,700 coupon eligible products.

×

Sales from

:

11/29/2023 02:03

Purchased: 27times

Price:¥23,800 (taxed)

About 1-Click Order

●Payment

Forward Test

Back Test

¥1,700 coupon eligible products.

×

Sales from : 11/29/2023 02:03

Purchased: 27times

Price:¥23,800 (taxed)

About 1-Click Order

●Payment

About Forex Automated Trading

What is Forex Automated Trading (MT4 EA)?

Forex Automated Trading refers to trading that is automated through programming, incorporating predetermined trading and settlement rules. There are various methods to conduct automated trading, but at GogoJungle, we deal with Experts Advisors (hereinafter referred to as EA) that operate on a trading platform called MT4.

Trading Types of Forex Automated Trading

There are various types of EAs (Expert Advisors) for different trading types that can be used on MT4.

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Just like discretionary trading, there are those that decide trading and settlement timings by combining indicators, those that repeatedly buy or sell at certain price (pips) intervals, and trading methods that utilize market anomalies or temporal features. The variety is as rich as the methods in discretionary trading.

To categorize simply,

・Scalping (Type where trades are completed within a few minutes to a few hours),

・Day Trading (Type where trades are completed within several hours to about a day),

・Swing Trading (Type where trades are conducted over a relatively long period of about 1 day to 1 week)

・Grid/Martingale Trading (Holding multiple positions at equal or unequal intervals and settling all once a profit is made. Those that gradually increase the lot number are called Martingale.)

・Anomaly EA (Mid-price trading, early morning scalping)

Risks, Advantages, and Disadvantages of Forex Automated Trading

When engaging in Forex, there are risks in automated trading just as there are in discretionary trading.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

However, a substantial advantage of automated trading is its ability to limit and predict risks beforehand.

[Risk]

Inherent to forex trading are the trading risks that undeniably exist in automated trading as well.

・Lot Size Risk

Increasing the lot size forcibly due to a high winning rate can, in rare instances, depending on the EA, lead to substantial Pips loss when a loss occurs. It is crucial to verify the SL Pips and the number of positions held before operating with an appropriate lot.

・Rapid Market Fluctuation Risk

There are instances where market prices fluctuate rapidly due to index announcements or unforeseen news. System trading does not account for such unpredictable market movements, rendering it incapable of making decisions on whether to settle in advance or abstain from trading. As a countermeasure, utilizing tools that halt the EA based on indicator announcements or the VIX (fear index) is also possible.

[Benefits]

・Operates 24 hours a day

If there is an opportunity, system trading will execute trades on your behalf consistently. It proves to be an extremely convenient tool for those unable to allocate time to trading.

・Trades dispassionately without being swayed by emotions

There is an absence of self-serving rule modifications, a common human tendency, such as increasing the lot size after consecutive losses in discretionary trading or, conversely, hastily securing profits with minimal gains.

・Accessible for beginners

To engage in Forex trading, there is no prerequisite to study; anyone using system trading will achieve the same results.

[Disadvantages]

・Cannot increase trading frequency at will

Since system trading operates based on pre-programmed conditions, depending on the type of EA, it might only execute trades a few times a month.

・Suitability may vary with market conditions

Depending on the trading type of the EA, there are periods more suited to trend trading and periods more suited to contrarian trading, making consistent results across all periods unlikely. While the previous year might have yielded good results, this year's performance might not be as promising, necessitating some level of discretion in determining whether it is an opportune time to operate.

Equipment and Environment Needed for Automated Trading Operation

The requirements for operating automated trading (EA) on MT4 are as follows:

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

・MT4 (MetaTrader 4. An account needs to be opened with a Forex company that offers MT4.)

・EA (A program for automated trading)

・The operating deposit required to run the EA

・A PC that can run 24 hours or a VPS (Virtual Private Server), where a virtual PC is hosted on a cloud server to run MT4.

Installation of MT4 and Account Login

If you open an account with a forex broker that supports MT4, you can use MT4 as provided by that forex broker. MT4 is a stand-alone type of software that needs to be installed on your computer, so you download the program file from the website of the FX company where you opened the account and install it on your computer.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

Additionally, there are both demo and real accounts available. You can experience trading with virtual money by applying for a demo account. After opening a real account, you select the connection server assigned by the Forex broker, enter the password, and log in to the account.

When you deposit money into your account using the method specified by the forex broker, the funds will be reflected in your MT4 account, and you can trade.

How to Install EA on MT4

To set up an EA when you purchase it through GogoJungle, follow the steps below:

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

Firstly, download the purchased EA file from your My Page on GogoJungle. You will download a zip (compressed) file, so right-click to extract it and retrieve the file named ‘◯◯◯ (EA name)_A19GAw09 (any 8 alphanumeric characters).ex4’ from inside.

Next, launch MT4 and navigate to ‘File’ → ‘Open Data Folder’ → ‘MQL4’ → ‘Experts’ folder, and place the ex4 file inside. Once done, close MT4 and restart it. Then, go to the upper menu ‘Tools’ → ‘Options’, and under ‘Expert Advisors’, ensure ‘Allow automated trading’ and ‘Allow DLL imports’ are checked, then press OK to close.

The necessary currency pair and time frame for the correct operation of the EA are specified on the EA sales page. Refer to this information and open the chart of the correct currency pair time frame (e.g., USDJPY5M for a USD/Yen 5-minute chart).

Within the menu navigator, under ‘Expert Advisors’, you will find the EA file name you placed earlier. Click to select it, then drag & drop it directly onto the chart to load the EA. Alternatively, you can double-click the EA name to load it onto the selected chart.

If ‘Authentication Success’ appears in the upper left of the chart, the authentication has been successful. To operate the EA, you need to keep your PC running 24 hours. Therefore, either disable the automatic sleep function or host MT4 on a VPS and operate the EA.

In Case You Want to Change the Account in Use

EAs from GogoJungle can be used with one real account and one demo account per EA.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

If you want to use it with an account other than the authenticated one, you need to reset the registered account.

To reset the account, close the MT4 where the Web authentication is registered, then go to My Page on GogoJungle > Use > Digital Contents > the relevant EA > press the ‘Reset’ button for the registration number, and the registered account will be released.

When the account is in a reset state, using the EA with another MT4 account will register a new account.

Also, you can reset the account an unlimited number of times.

Solutions for Errors During Web Authentication or Non-Functional Account Trading

If you encounter an error with Web authentication, or if the EA is trading on GogoJungle's forward performance page but not on your own account, there could be various reasons. For more details, please refer to the following link:

→ Items to Check When EA is Not Operating

→ Items to Check When EA is Not Operating

About the Size of Trading Lots

In Forex trading, the size of a lot is usually:

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

1 lot = 100,000 currency units

0.1 lot = 10,000 currency units

0.01 lot = 1,000 currency units

For USD/JPY, 1 lot would mean holding 100,000 dollars.

The margin required to hold lots is determined by the leverage set by the Forex broker.

If the leverage is 25 times, the margin required to hold 10,000 currency units of USD/JPY would be:

10000*109 (※ at a rate of 109 yen per dollar) ÷ 25 = 43,600 yen.

Glossary of Automated Trading

・Profit Factor: Total Profit ÷ Total Loss

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

・Risk-Return Ratio: Total Profit and Loss during the period ÷ Maximum Drawdown

・Maximum Drawdown: The largest unrealized loss during the operation period

・Maximum Position Number: This is the maximum number of positions that the EA can theoretically hold at the same time

・TP (Take Profit): The set profit-taking Pips (or specified amount, etc.) in the EA's settings

・SL (Stop Loss): The set maximum loss pips (or specified amount, etc.) in the EA's settings

・Trailing Stop: Instead of settling at a specified Pips, once a certain profit is made, the settlement SL is raised at a certain interval (towards the profit), maximizing the profit. It is a method of settlement.

・Risk-Reward Ratio (Payoff Ratio): Average Profit ÷ Average Loss

・Hedging: Holding both buy and sell positions simultaneously (Some FX companies also have types where hedging is not allowed)

Useful related pages

・How to Install MT4 EA (Expert Advisor) and Indicators

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working

・MT4 Beginner's Guide

・Understanding System Trading Performance (Forward and Backtesting)

・Choosing Your First EA! Calculating Recommended Margin for EAs

・Comparing MT4 Accounts Based on Spread, Swap, and Execution Speed

・What is Web Authentication?

・Checklist for When Your EA Isn't Working