Gargoyle GBPJPY_M5

- 全期間

- 2年

- 1年

- 6カ月

- 3カ月

- 1カ月

リアル運用(pips)

※スワップと手数料を含めて成績を表示しています

公式運用(収益額)

詳細統計(月別)

- 1月

- 2月

- 3月

- 4月

- 5月

- 6月

- 7月

- 8月

- 9月

- 10月

- 11月

- 12月

今月のカレンダーを表示

ストラテジーについて

Translating...

EAで動かすなら裁量要素は無いほうがいい

Gargoyleは私の裁量手法の落とし込みが基本となっております。

そのためテクニカル分析が基本となっておりますが、指標などはどうしても警戒する必要があります。

しかしEA を稼働させているときに、指標だからといってチャートの前にいなければいけないのであれば「裁量でやった方が早い」と思ってしまいます。

その点を加味しながら、できるだけほったらかしで運用できるようにロジックに制限を加えることで、EAを手動で稼働停止する必要をなくしました。

自身が裁量トレーダーでもありますので、設置した後に「指標や年末年始などに稼働を停止するなどの裁量が入らない」ことこそがEAの醍醐味であると思っておりますので、

基本的にほったらかしでの運用を想定して制作しております。

大きめの指標に対する対策

ロジックに制限をかけているとはいえ、大きな指標時にスプレッドが大きく開いてしまうと勝率はやはり著しく下がります。

それに対応するためスプレッドフィルターを搭載しております。

お使いのブローカーの平均スプレッドの1.5倍程度に設定していただくようにお願いいたします。(初期値5pips)

設定例➝例えば平常時の平均スプレッドが1pipsの場合は1.5pips程度で設定ください。

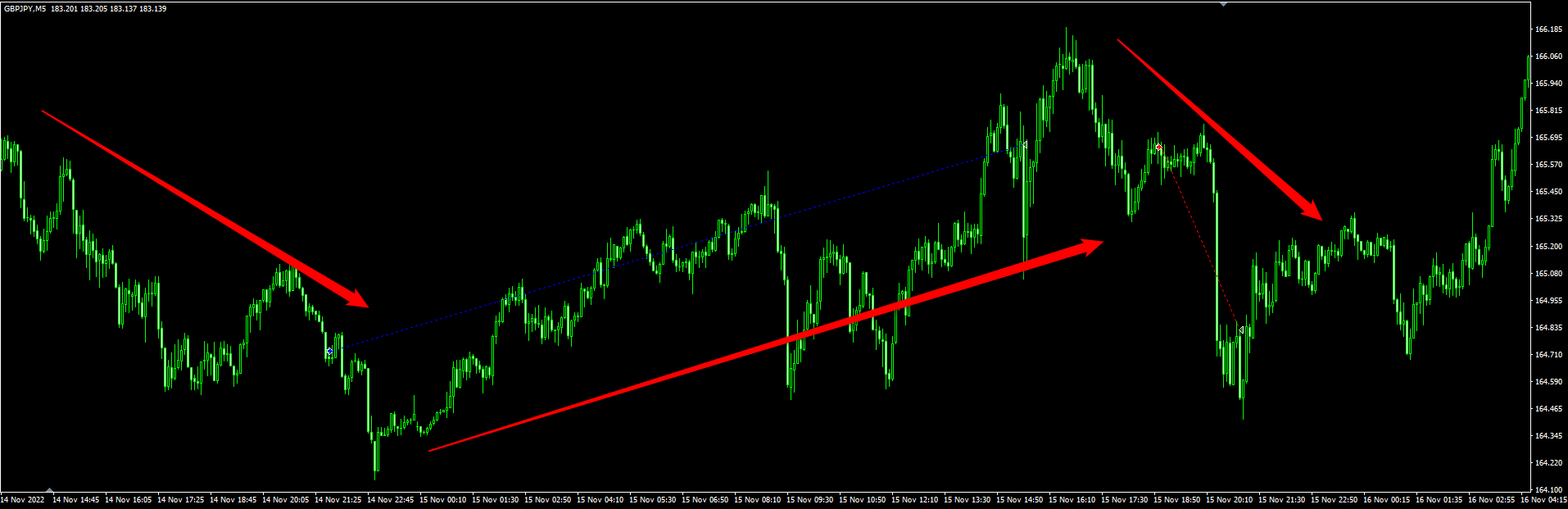

波の転換の初動を捉える

MacDの0ラインを基準にすることで波の転換を一早く捉え、買いも売りも乗り遅れないようにポジションを取るようにロジックを組んでいます。

しかし単純にインジケーターに従って波の転換を意識するだけでは「ダマシ」に対しての対応が間に合わないので、計算期間の違うMacDを挟み長期と短期の波の波長をずらすことで

MacDによるダマシを極力回避するように設計しています。

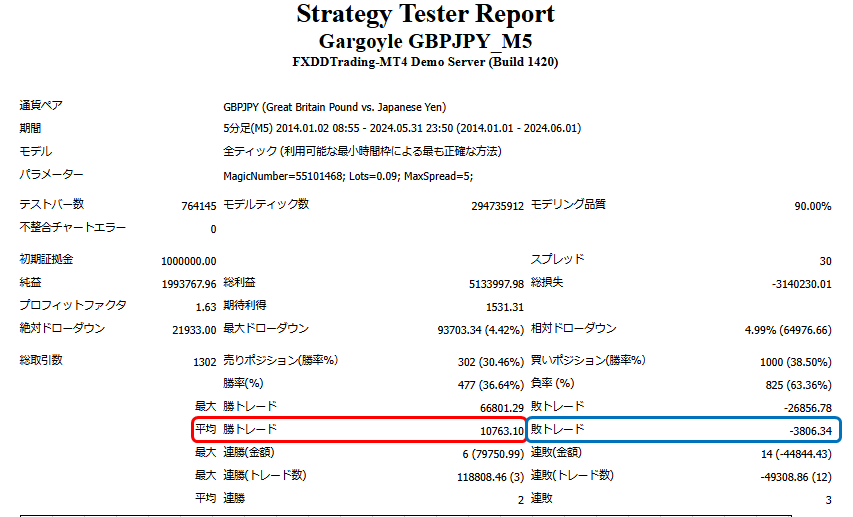

2.5:1のリスクリワードをEAで実現

投資の基本である損小利大のリスクリワードは2:1程度と言われていますが、Gargoyleはさらに大きな2.5:1のリスクリワードを実現しました。

リスクリワードが高ければ負けが続いた際に原状回復までのスピードが速くなります。自動売買であるからこそ負けが続いた時の不安を極力取り除けるように設計しています。

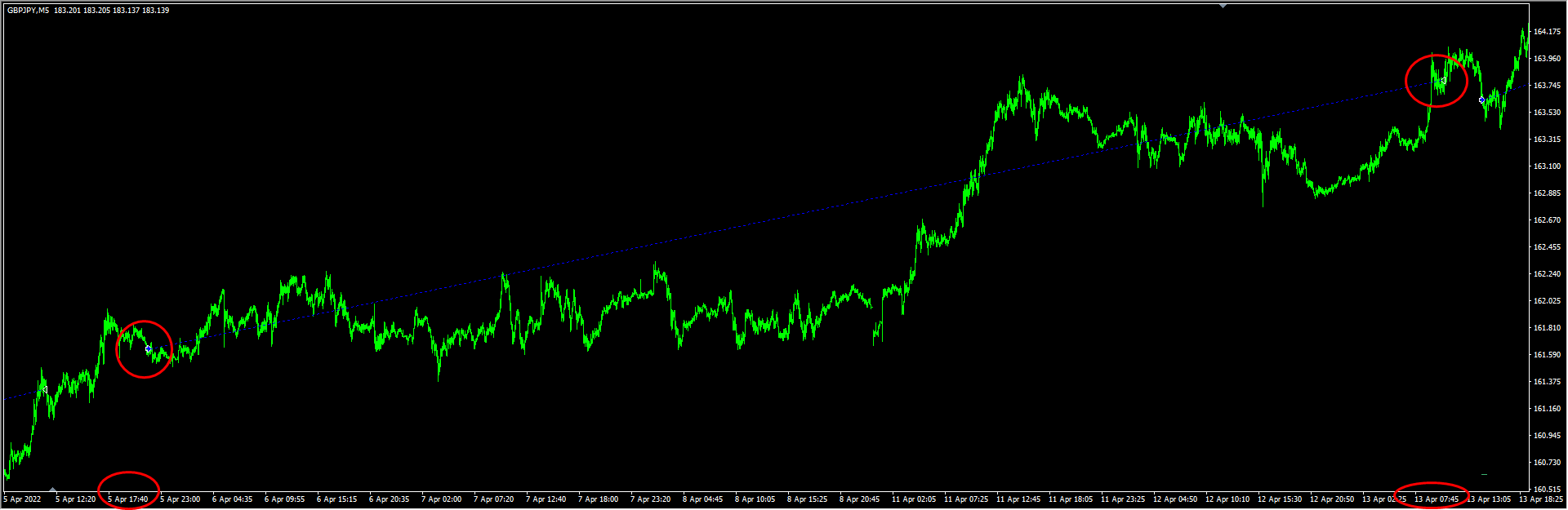

トレンド発生時は条件が崩れるまで保有し続ける

MacDを指標としてトレンドを掴みますので、その条件が崩れるまでは保有し続けることがこのEAの強みです。

勝率を上げようとすればどうしてもトレンド発生時もできるだけ早く利確をすることを余儀なくされますが、このEAはMacDの条件が崩れるまでは利確をなるべくしないように設計しています。

これにより画像で確認できる約1週間程度の上昇トレンドなどは、途中で利確することなく波を取り切ることもありえます。

(価格到達時のTP設定やトレーリングによる利益確定などの自動設定は行いますので、MacDの条件が崩れていなくてもポジションを決済することはあります)

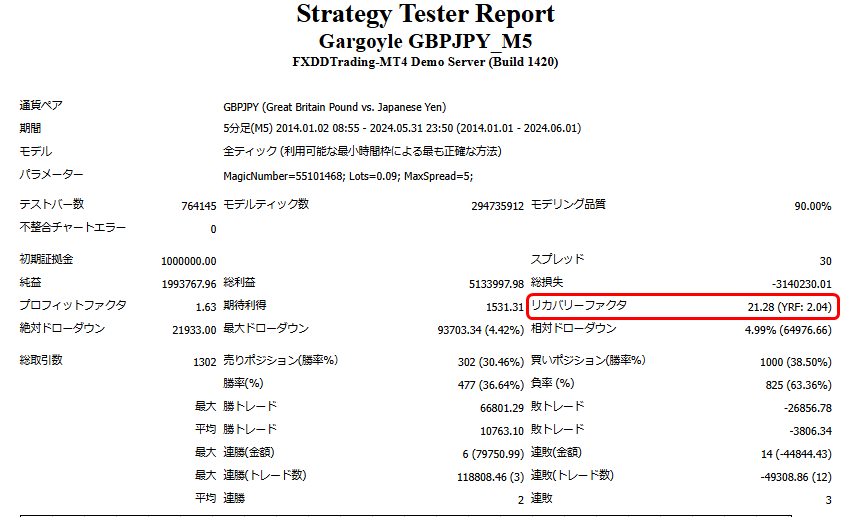

リカバリーファクターの高さ

ガーゴイルの特徴としてリカバリーファクターの高さがあります。

リカバリーファクターとは「ドローダウンを受けた時に元に戻るまでのリカバリー力(りょく)」のことを言います。

EAには必ずドローダウン期が訪れます。

しかしリカバリーファクターが高ければドローダウンを受けても資金回復の速度が早いので、稼働を止めてしまいたくなるような不安が少なくなります。

Gargoyleのリカバリーファクターは21.28と良いEAの基準とされる10を大きく上回り、年間平均でも「2.04」となっております。

価格設定について

EAを稼働させる方の平均準備金と言われる約30万円をもとに、理論上半年で原資回収できるように設定しております。

Gargoyleの年利は過去10年の利回りを平均して20%となっておりますので、多少悪い年が初年度だとしても1年程度で回収できる価格にさせていただきました。

(理論上ですので必ず回収できるわけではないことはご了承ください)

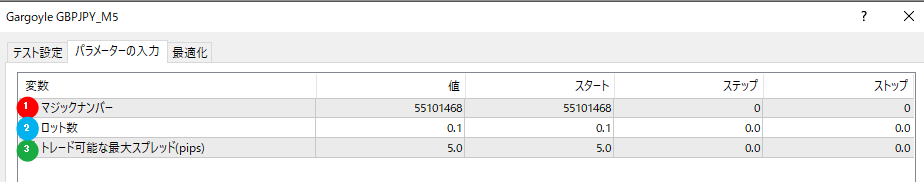

パラメーターについて

設定できるパラメーターについて解説します。

①マジックナンバー:お好きな番号を入力してください。ただし他のEAと被らないようにお願いします。

②ロット数:お好きなロットを入力できます。レバレッジのかけすぎに注意してください。初期値の0.09は証拠金100万円で最大DD10%以下の推奨ロット数です。

③エントリーを許可するスプレッドを指定します。経済指標時などスプレッドが大きく開いた場面などでのエントリー制御に使用します。

注意事項

※本EAは利益を確約するものではありません。今後の相場状況によっては過去のテスト以上の損失が出る場合もありますのでご了承ください。

※バックテストは固定スプレッド3.0pipsで行っております。それ以上のスプレッドでは著しく成績が悪くなる恐れがあります。

※ロット以外のパラメーターはEAの性能を著しく悪化させる恐れがあるため変更不可とさせていただいております。ご利用の際はご理解の上、ご使用いただくようお願いいたします。

価格:¥24,800 (税込)

●お支払い方法

REAL TRADE

販売開始日 : 2024年7月24日 10時02分

価格:¥24,800 (税込)

●お支払い方法

裁量トレードと同じように、インジケーターを組み合わせて取引タイミングや決済タイミングを決めるもの、一定の価格(pips)間隔で買いや売りを繰り返すもの、相場のアノマリーや時間的特徴を利用した取引手法など、その種類は裁量トレードの手法と同じく豊富です。

簡単に分類すると、

・スキャルピング(数分~数時間以内で取引が完了するタイプ)、

・デイトレード(数時間~1日程度で取引が完了するタイプ)、

・スイング(1日以上~1週間程度の比較的長い期間をかけて取引を行うタイプ)

・ナンピン・マーチン(等間隔または不等間隔で複数のポジションを持ち、利益が出たら一括で決済をするタイプ。ロット数を段階的に上げていくものをマーチンゲールといいます。)

・アノマリーEA(仲値トレード、早朝スキャルピング)

などがあります。

ただし、自動売買は予めリスクを限定できる、予想できるということが大きな強みでもあります。

【リスク】

FX取引をする以上は取引リスクは自動売買にももちろん存在します。

・ロットサイズのリスク

勝率が高いからといってロットを無理に大きくすると、EAによってはまれに負けた時の損失Pipsが大きい場合があります。必ずSLのPipsや保有ポジション数を確認してから、適切なロットで運用しましょう。

・急激な相場変動リスク

指標発表や、突発的なニュースによって急激に相場が動くケースがあります。システムトレードはそのような予測できない相場の動きを想定していないため、事前に決済しておく、取引しないなどの判断が出来ません。対策としては指標発表やVIX(恐怖指数)でEAの停止を行うツールなどを使うことも可能です。

【メリット】

・24時間取引してくれる

システムトレードはあなたの代わりに取引できるチャンスがあれば、淡々とトレードを行ってくれます。トレードに時間を割けない方にとってはとても便利な武器になってくれるでしょう。

・感情にコントロールされることなく淡々とトレードしてくれる

裁量トレードで負けが続き、ロットを大きくしてみたり、逆に少ない利益ですぐに利確してしまうといった、人間にありがちなルールの自己都合化がありません。

・初心者でも始められる

FX取引を行うにはまず勉強から…といった必要がなく、誰が使っても同じ結果になるのがシステムトレードです。

【デメリット】

・取引頻度を自由に増やせない

システムトレードは予めプログラムされた条件通りに取引をするため、EAのタイプによっては月に何度かしか取引をしない場合もあります。

・相場に合う、合わないがある

EAの取引タイプによって、順張りに向いている時期、逆張りに向いている時期などがあるため、すべての期間において成績が一定になることは少ないです。去年は良かったが、今年はあまり成績が振るわないということもあるため、運用する時期なのかどうかをある程度裁量で判断する必要があります。

・MT4(MetaTrader4。MT4が使えるFX会社で口座開設をする必要があります)

・EA(自動売買用プログラム)

・EAを運用するのに必要な運用資金

・24時間稼働可能なPCまたはVPS(クラウドサーバー上に仮想PCを置き、そこでMT4を立ち上げておく)

また、口座にはデモ口座とリアル口座があり、デモ口座を申請すると仮想の資金でトレードを体験することができます。リアル口座を開設したあと、FX会社から割り振られた接続サーバーを選択し、パスワードを入力して口座にログインします。

FX会社に指定された方法で口座資金を入金すると、MT4口座に資金が反映されて取引ができるようになります。

まず、購入したEAファイルをGogoJungleのマイページからDLします。zip(圧縮)ファイルがDLされるので、右クリックで解凍して中の「◯◯◯(EA名称)_A19GAw09(任意の8英数字).ex4」というファイルを取り出します。

次に、MT4を立ち上げ、「ファイル」→「データフォルダを開く」→「MQL4」→「Experts」フォルダーの中に、ex4ファイルを入れます。MT4を一度閉じ、再起動したら、上部メニューの「ツール」→「オプション」の「エキスパートアドバイザー」の「自動売買を許可する」、「DLLの使用を許可する」にチェックを入れてOKを押して閉じます。

EAの正しい運用に必要な通貨ペアと時間足がEA販売ページに書いてあるので、それを参照して正しい通貨ペアの時間足のチャートを開きます(例:USDJPY5M ドル円5分足)。

メニューのナビゲーター内、「エキスパートアドバイザ」に先ほど入れたEAファイル名があるので、クリックして選択し、そのままドラッグ&ドロップでチャート内にEAを載せます。EA名ダブルクリックでも、選択されているチャートに載せることができます。

チャート上の左上に、「Authentification Success」と出れば認証成功です。 EAの運用には、24時間PCを立ち上げて置く必要がありますので、自動スリープ機能を解除するか、VPS上にMT4を置いてEAを運用ください。

認証されている口座以外で利用したい場合は、登録口座をリセットする必要があります。

口座のリセット方法は、Web認証が登録されているMT4を閉じている状態で、

GogoJungleのマイページ>利用する>デジタルコンテンツ>該当のEA>登録番号の「リセット」ボタンを押すと、登録口座が解除されます。

口座がリセットされている状態で、他のMT4口座でEAを利用すると、新たに口座が登録されます。

また、口座のリセットは無制限に行っていただけます。

→ EAが動かない時にチェックする項目

1ロット=10万通貨

0.1ロット=1万通貨

0.01ロット=1000通貨

となります。

ドル円であれば1ロット=10万ドルを保有することになります。

ロット保有にかかる証拠金はFX会社の定めるレバレッジによって決まります。

レバレッジ25倍であれば、1万通貨のドル円を保有するのに必要な証拠金は 10000*109(※1ドル109円レート時)÷25 = 43,600円 となります。

・リスクリターン率:期間中損益の合計÷最大ドローダウン

・最大ドローダウン:運用期間中の最大含み損

・最大ポジション数:そのEAが理論上同時に持ちうる最大のポジション数です

・TP(Take Profit):EAの設定上の利確Pips(または指定された金額など)

・SL(Stop Loss):EAの設定上の最大損失pips(または指定された金額など)

・トレーリングストップ:決済を指定のPipsで行うのではなく、一定の利益が出たら決済SLを一定の間隔で引き上げて(利益の方向へ)行く、利益を最大化する決済方法です。

・リスクリワード率(ペイオフレシオ):平均利益÷平均損失

・両建て:買いと売りを同時に保有すること(一部のFX会社では両建て不可のタイプもあります)

人気商品

特定商取引法に基づく表示

株式会社ゴゴジャン

早川忍

〒113-0033

東京都文京区本郷3-6-6 本郷OGIビル6F

お問い合わせページよりお願い致します。

03-5844-6090

月曜日~金曜日

10:00~19:00

セミナーのリアルタイム動画配信サービス・動画配信サービス、対面式セミナー、電子書籍、ソフトウェア、シグナル配信、セミナーのビデオ

※セミナーのリアルタイム動画配信サービスとは、セミナー実施時に即時弊社サーバーより配信するサービスです。

※セミナーの動画配信サービスとは、保存されたセミナー動画を弊社サーバーより配信するサービスです。

※セミナーのビデオとは、保存されたセミナー動画をお客様のPCにダウンロードするサービスです。

各商品の販売価格は、商品ページにて税込価格で表示しております。

オンライン上でのダウンロード、または配信

https://www.gogojungle.co.jp/

原則として弊社によるお客様のご入金完了後即ご提供いたします。

銀行振り込みご利用の場合は、商品代金(税込表示)に加えて振り込み手数料がかかります。

ホームページ上の専用申込フォームよりご注文ください。

銀行振込 / クレジットカード決済/ Web口座振替/ コンビニ決済

ファミリーマートでのお支払い方法

デイリーヤマザキ・ヤマザキデイリーストアーでのお支払い方法

お申込み日から2日以上経つ場合、お申込をキャンセルさせていただきます。予めご了承ください。

1.セミナーのリアルタイム動画配信サービス、動画配信サービスは配信実施24時間前以降のキャンセルはお受けいたしておりません。ご返金対応ができませんので十分ご注意ください。

2.対面式セミナーは、開催の3営業日前以降のキャンセルおよびご返金はお受けいたしておりません。

3.電子書籍、ソフトウェア、ビデオは、著作権保護の観点からお客様のダウンロード実施、または購読開始以降はキャンセルできません。ご返金対応ができません。予めご了承ください。

お客様のご都合によるご返金は、銀行振込・コンビニ決済・Web口座振替の場合振込手数料がすべてお客様負担となります。

カード決済ご利用の場合手数料は生じません。あらかじめご了承ください。

当ページに記載する「発送方法、ご提供方法」「発送時期、 ご提供時期」「代金以外の必要料金」「注文方法」「お支払い方法・期限」

「商品注文後のキャンセル」「返金にかかる費用」の各項目はGogoJungleで販売する全ての商品に適用されますが、商品毎にご案内がある場合は、

商品毎に記載いたします。

GogoJungleが販売者である場合は、商品ページにGogoJungleの「特定商取引に関する法律」に基づく表記を行ないます。

出品者が販売者であり、且つ出品者が「事業者」である場合は、出品者の「特定商取引に関する法律」に基づく表記を行ないます。

出品者が「事業者」に該当するかは出品者の判断によります。ただし、 経済産業省 特定商取引法の通達の改正について

「インターネット・オークションにおける「販売業者」に係るガイドライン」

https://www.caa.go.jp/policies/policy/consumer_transaction/amendment/2016/pdf/amendment_171206_0001.pdf

を鑑み「事業者」であることが明らかな出品者については、「事業者」として扱い開示請求があった場合は迅速に対応します。